2 Early Earnings Winners

Good morning everyone - Happy Monday!

I hope you’ve enjoyed our 3-day hiatus.

As traders, it’s critical to take time away from screens and allow ourselves to reconnect with “reality.” I ventured into the wilderness with my Minimal Phone, no data, and a loose agenda. It was bliss.

I highly encourage everyone to check out Castle Valley near Moab, Utah. It’s one of my favorite landscapes in the country. While you’re at it - check out the Wall Street of the West… ;)

Onward.

Today’s Tape

The major indices continue to trade at or near their all-time highs. And I suspect we’ll see a clean resolution soon.

Last Friday, I closed the majority of my outstanding risk to lock in a hot start to 2026. The majority of my gains were a result of post-earnings drifts from the Fall 2025 earnings season.

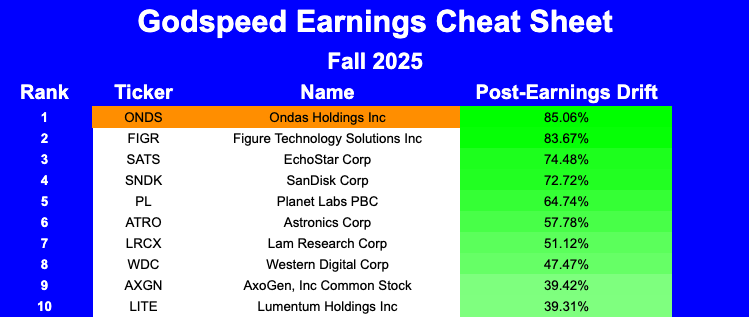

Here’s my Fall 2025 “earnings drift” cheat sheet for reference.

We saw more than a half dozen stocks drift over 50% following their post-earnings closing prints. Ondas, Figure Tech, EchoStar, SanDisk, and PlanetLabs were the shining stars.

And the “AI Industrial Revolution” is still in play.

At the moment — Space, Next-Gen Defense, Memory, Data Centers and Nuclear are the sub-themes exhibiting relative strength. It’s likely we’ll see rotation in the coming weeks as more companies report.

The major banks kicked off the festivities last week with strong reports, and lack-luster reactions. $XLF fell -2.31% on the week. Something to note, but not something to overthink.

Taiwan Semis posted strong figures Thursday - making it one of the first “tech” earnings reports of the season. $TSM gained +4.44% following the numbers - a positive heuristic for the health of the AI trade as we dive deep into earnings.

Here’s the daily chart.

Looking Ahead

It’s impossible for us to predict what stocks will yield outstanding returns, but if we watch closely, the cream will rise to the top.

My plan is to wait, watch the figures hit the tape, and let the stocks trade. From this approach, we can step in with small size and build positions in the strongest stocks over time.

There are a few names that already reported that I want us to watch closely in the coming days // weeks.

Applied Digital builds and operates data centers that provide compute infrastructure for AI. The company reported earnings January 7th and the stock is up +17% since. $APLD registered +250% revenue growth while cutting its net loss 76% YoY.

Applied Digital is primed to post profitability in 2026, and the stock price is reflecting this.

Check out the daily chart.

And monster monthly chart.

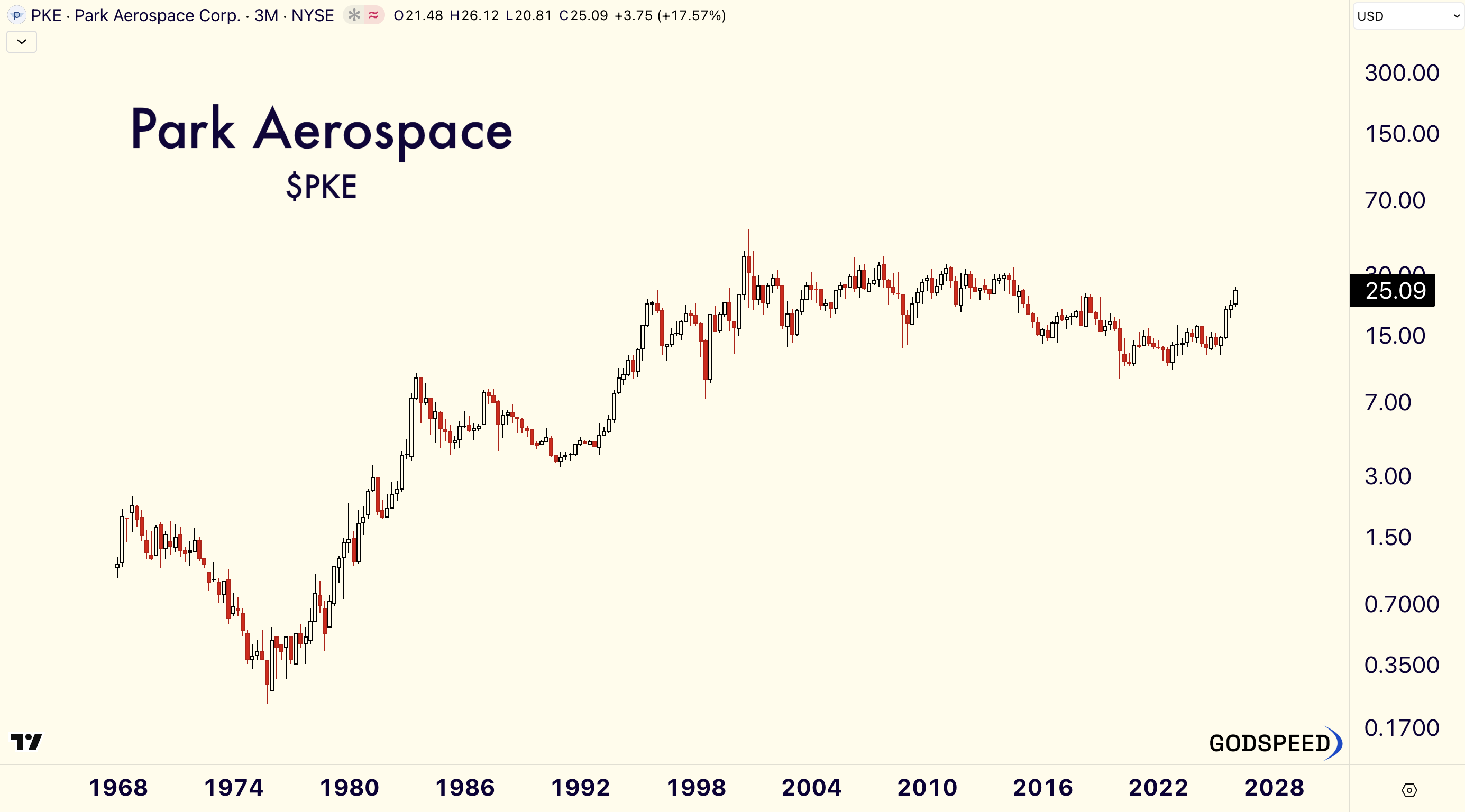

Park Aerospace manufactures advanced composite materials used in commercial and military aircraft. The company grew EPS 87%, and revenue accelerated +20% YoY.

We’ve seen the strength in small caps over the last weeks // months. As well as the aerospace + defense industry. Park Aerospace falls under BOTH of these categories.

$PKE closed at its highest price since December 2014. As JC likes to say, “the bigger the base, the higher in space.”

Here’s the daily chart.

And monster 3M chart.

Disclosure: This is not financial advice.