Happy Friday, folks!

Just a quick note, and I’ll follow up with another Case Study on Saturday.

Let’s dive in.

Today provides a strong cautionary tale as to why I WAIT for companies to report earnings BEFORE initiating a new position.

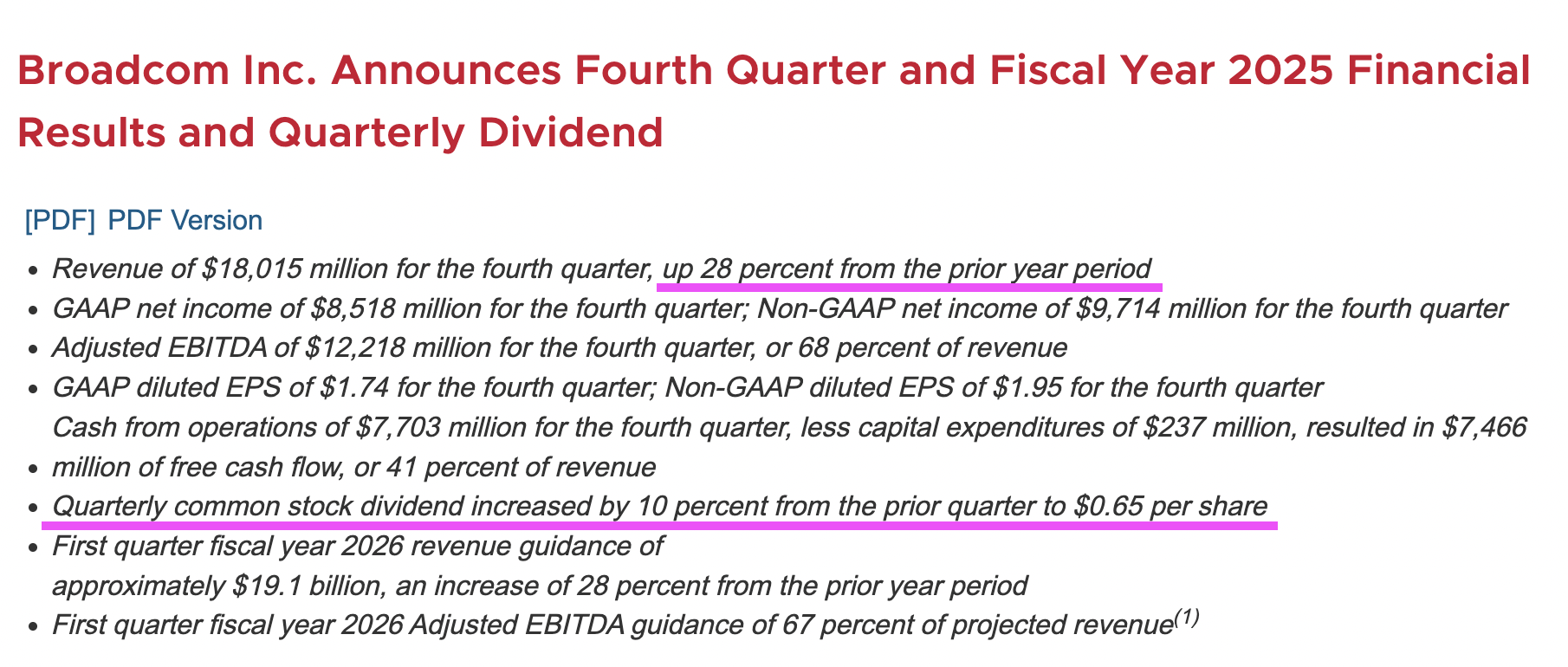

Last night, after the close, Broadcom ($AVGO) reported its Q3 2025 earnings.

Everything about the report looked terrific.

Revenue grew nearly 30% YoY. The company raised its quarterly dividend +10%. And increased its forward looking guidance.

But despite the abundant success, $AVGO has tumbled approx. -10% in today’s session.

You may ask why… And it’s a valid question.

But as an active asset manager, the reason “why” is irrelevant.

The market is speaking, and thus far - Broadcom sellers are in control.

This doesn’t mean I won’t take a position in $AVGO down the road, but I read today’s tape as a sign that the time is not right.

And folks - timing is everything.

Where’s The Strength?

Ondas Holdings has really caught my eye today.

Across the board, tech is under pressure. And as I type, the technology sector ETF $XLK is down -2.3%.

However, $ONDS is green. A great sign of relative strength.

Now - I want to be clear, this stock is a wild child. It rips and dips like a kid who can’t sit still.

Allocate accordingly.

Disclosure: This is not financial advice.