The Land That Compounds

The Land That Compounds

How Texas Pacific Land turned a 140-year-old land grant into a compounding engine.

It doesn’t build.

It doesn’t drill.

It doesn’t innovate, at least not like Silicon Valley.

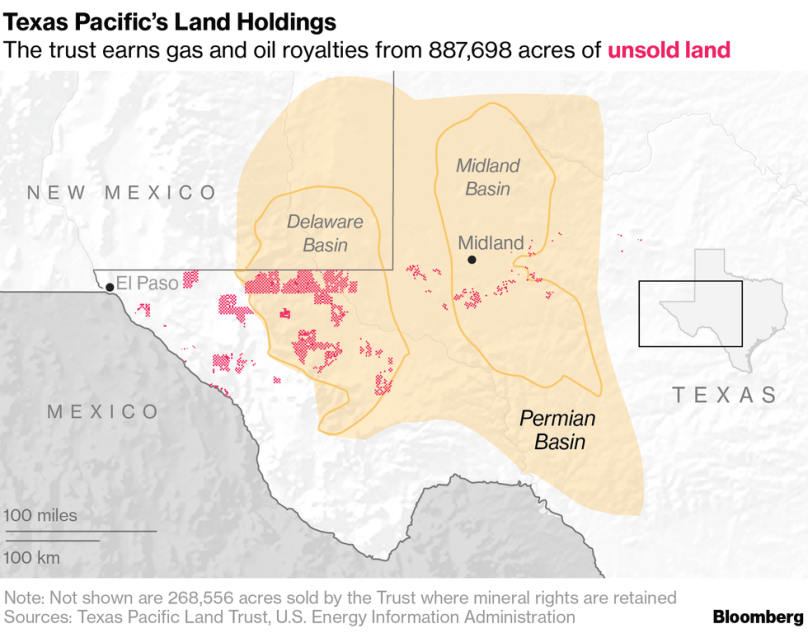

But across 880,000 acres in the Permian Basin, Texas Pacific Land found something better: A way to get paid every time someone else tries to.

Timeline: Inflection Points That Changed Everything

1996–2009: The Dormant Phase

- Legacy land trust trades quietly.

- No drilling, no development, no debt.

- Acts like a perpetual coupon clipped off Texas soil.

2010–2015: The Shale Supercycle Begins

- Horizontal drilling and hydraulic fracturing go mainstream.

- Permian operators flood in.

- Royalty income at TPL explodes. 0 Capex.

2016: Delaware Basin Rediscovers Itself

- New discoveries in Reeves County (TPL core acreage).

- Improved drilling unlocks deeper zones under TPL land.

2017: Water Becomes a Business

- TPL launches Texas Pacific Water Resources.

- Builds out water sourcing, recycling, and analytics.

- Turns the frac bottleneck into a growth engine.

2021: Corporate Reorg

- Trust dissolves. TPL becomes a Delaware C-corp.

- Structure now supports broader operational ambitions.

2022: Bitcoin Moves In

- TPL leases land to crypto miners.

- New surface revenue stream appears, no drilling required.

2023–2024: Carbon, Renewables, Desalination

- CCUS deals, solar projects, and water treatment pilots signed.

- Fractional-freezing patent filed to desalinate produced water.

2025: The AI Land Grab Begins

- West Texas eyed for hyperscale data centers.

- TPL owns the surface, the water, and the power rights.

The Land That Waited

Texas Pacific Land was never designed to win a tech cycle.

It was designed to survive.

Formed in 1888 from the ashes of a bankrupt railroad, TPL inherited the one thing no one could print: land.

It sat on it for over a century, quietly collecting surface fees and royalties from whoever needed to dig, drill, or build.

No leverage. No operations. No big swings.

Just the slow grind of scarcity doing its work.

The World Came to Drill

Everything changed when technology caught up to geology.

By 2010, horizontal drilling and multi-stage fracking made the Permian Basin the center of U.S. energy again. And TPL — with hundreds of thousands of acres in its quiver — didn’t need to lift a finger.

Operators bore the risk. TPL collected the royalties.

Then in 2017, it went further…

Water was the constraint, so it built a system to manage it:

- Sourcing

- Recycling

- Treatment

- Analytics

Texas Pacific Water Resources turned the messiest part of shale into a high-margin utility.

Meanwhile, the surface stayed busy. Pipelines, roads, and caliche sales fed into the same model: If someone wanted to operate on TPL land, they paid.

Beyond Oil

Then the definition of “operator” changed.

By 2022, bitcoin miners had arrived, chasing cheap energy and empty land. TPL leased space. Took a royalty. Stayed agnostic.

In 2023, the next wave showed up:

- Solar developers

- Battery firms

- Carbon sequestration projects

- Water tech startups

The land didn’t care who showed up next. It just kept compounding.

Then came AI… As GPU clusters and hyperscale compute began looking for space and power, West Texas lit up. Suddenly TPL wasn’t just a royalty play, it was a physical on-ramp to the next great infrastructure cycle.

Let The Charts Speak

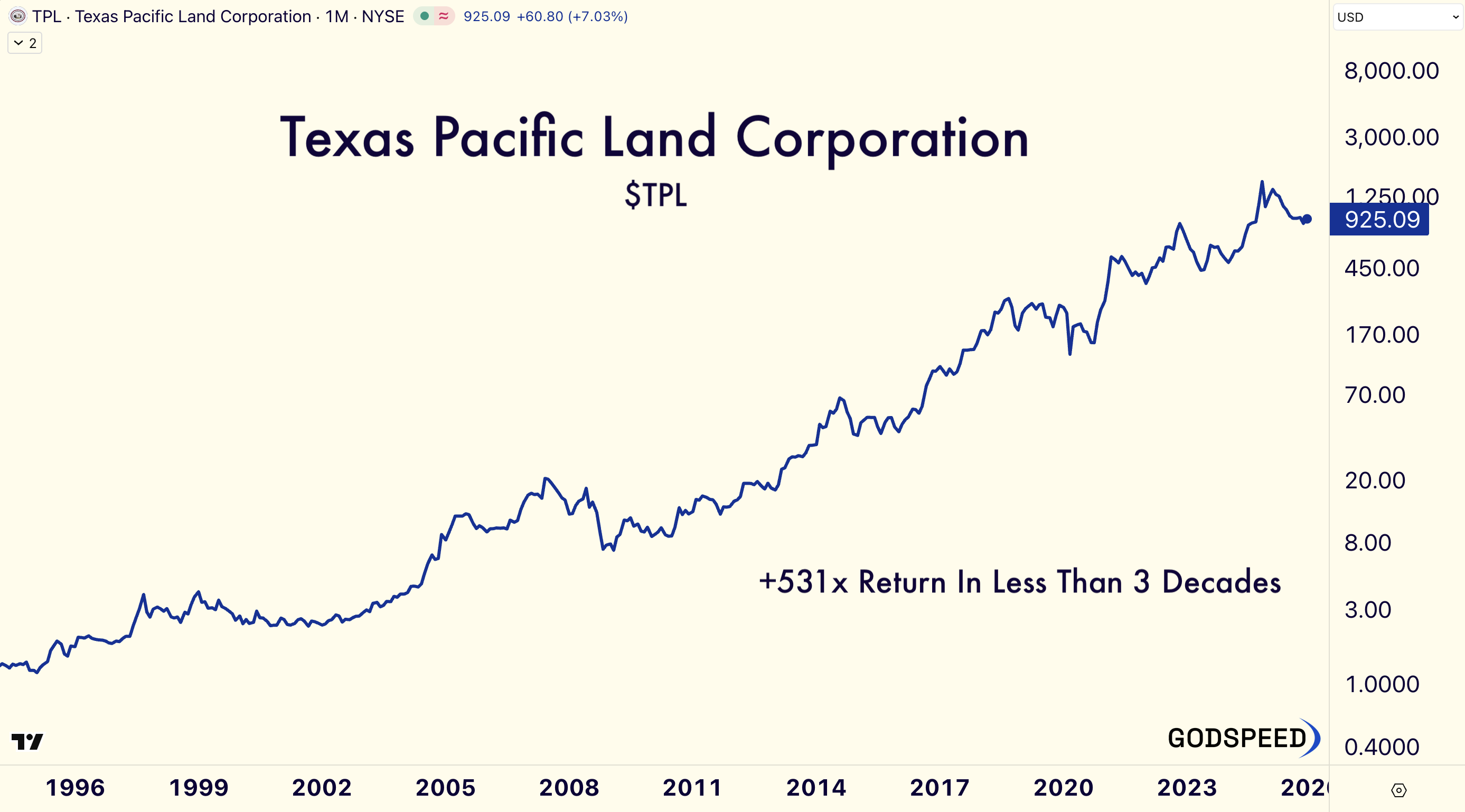

Since 1996, Texas Pacific Land has generated a 531x return for shareholders.

$TPL is also a very low float stock. With only 23M shares outstanding, it creates the opportunity for an imbalance between supply and demand.

Looking at the monthly chart, we see a work of art. A steady series of higher highs and higher lows.

This is the type of stock we want to own.

*I’d like to note, since its all-time high close on 11/22/24, $TPL has experienced a 50% drawdown. I’d want to see $TPL return to $1,200 before looking to add exposure.

**$TPL recently announced a 3-for-1 stock split, expected to take effect 12/23/2025.

Stillness as Strategy

Innovation usually looks like speed. But TPL proves it can come from stillness.

It didn’t try to predict the future. It waited for the future to need land, water, and power.

And then it cashed in.

Disclosure: This is not financial advice.