Amazon: Betting On What Doesn’t Change

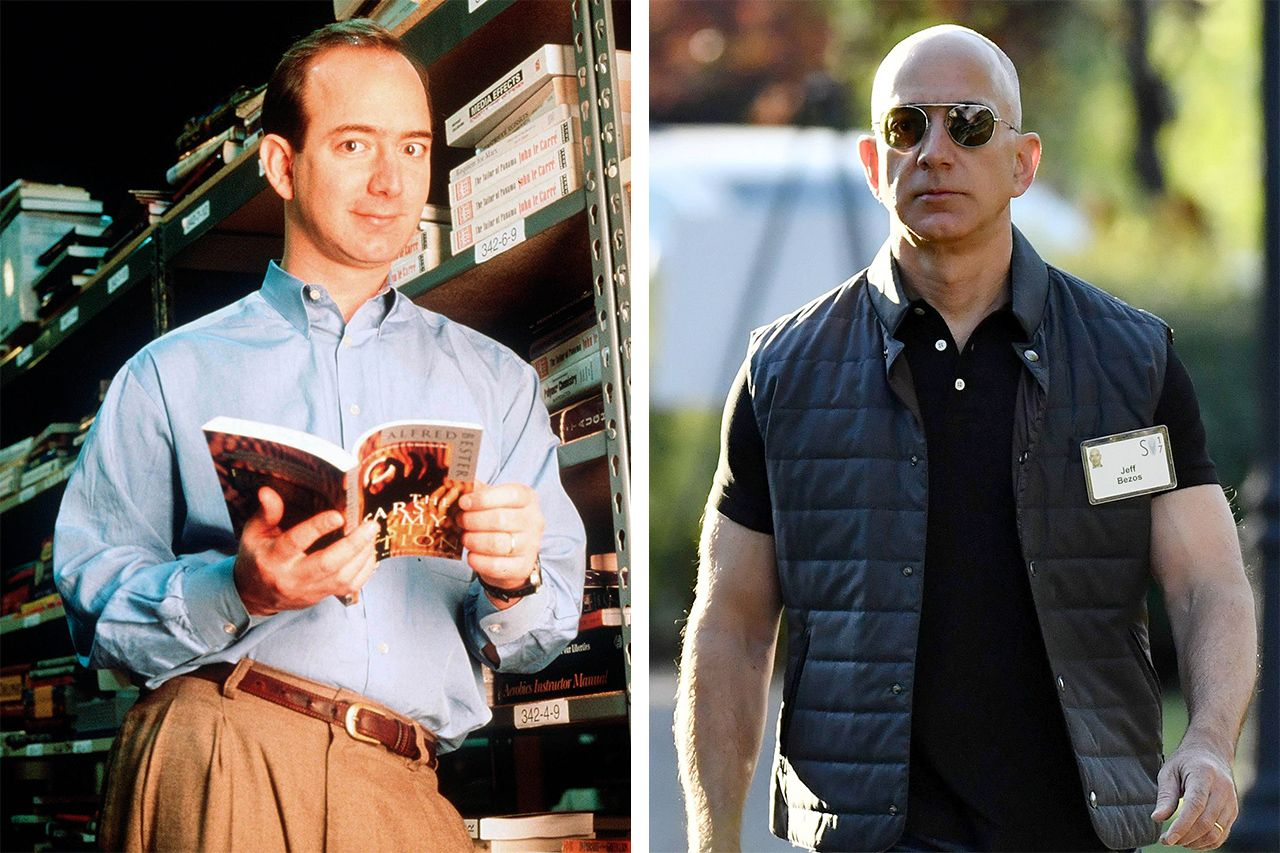

Jeff Bezos didn’t build Amazon by predicting the future.

He built it by betting on what would never change.

Bezos often noted that people obsess over what will change in the next ten years, but rarely ask what won’t.

He believed that customers would always want lower prices, faster delivery, and better selection.

Those desires are permanent.

Technology is simply the lever that allows them to scale.

Before founding Amazon, Bezos worked as a hedge fund analyst at D.E. Shaw, one of Wall Street’s most sophisticated quantitative firms.

There, he learned to think in probabilities, asymmetry, and long-duration payoff curves.

When he encountered data showing the internet growing at an extraordinary rate, he recognized a rare setup: a once-in-a-generation technological shift paired with timeless consumer behavior.

In 1994, Bezos left high-finance and launched Amazon.

Books were not the vision, they were the starting point.

From the beginning, Amazon was designed to prioritize scale, customer trust, and reinvestment over short-term profitability.

That philosophy - invest aggressively in businesses and behaviors that won’t change - became Amazon’s edge.

What followed was not a retail success story.

It was the construction of one of the most powerful compounding machines in modern economic history.

Timeline of Inflection Points (1994–Present)

1994-1997: The Experiment Began

Amazon was founded in Seattle in 1994 as an online bookstore. In 1997, the company went public. From the outset, Jeff Bezos warned investors that profitability could be delayed indefinitely.

Amazon filtered its shareholder base early. Long-term thinkers only.

1998-2001: Survival and Scar Tissue

Amazon expanded beyond books into music, electronics, and general merchandise. The dot-com collapse nearly killed the company.

Frugality became cultural. Efficiency became strategic.

2002-2006: Infrastructure Became the Moat

To support its growing retail business, Amazon built internal computing tools. In 2006, those tools were externalized as Amazon Web Services with the launch of S3 and EC2.

What began as internal infrastructure became the backbone of the internet.

AWS was not a side project, it became one of the greatest second acts in corporate history.

2007-2012: Ecosystem Lock-In

Amazon Prime evolved from free shipping into a loyalty and behavior-shaping engine. Amazon launched the Kindle in 2007, redefining digital media distribution. Fulfillment centers scaled globally.

Prime was not about shipping. It was about habit formation.

2013-2019: The Flywheel at Scale

AWS became Amazon’s primary profit engine. Third-party marketplace sellers surpassed first-party retail. Advertising quietly emerged as a high-margin business.

Amazon transitioned from retailer to platform operator.

By this point, Amazon was no longer one company. It had become a portfolio of dominant businesses reinforcing one another.

2020-2022: Pull-Forward and Pain

The pandemic accelerated years of demand into months. Amazon overbuilt logistics capacity. Margins compressed. Layoffs followed.

What looked like overreach was the cost of absorbing extraordinary demand at unprecedented speed.

2023-Present: Discipline, Margins, and AI

Amazon reset its cost structure. Fulfillment efficiency improved. AWS refocused on profitability and AI workloads. Advertising continued to scale.

Amazon entered its optimized-scale phase.

From $10,000 To $19,000,000

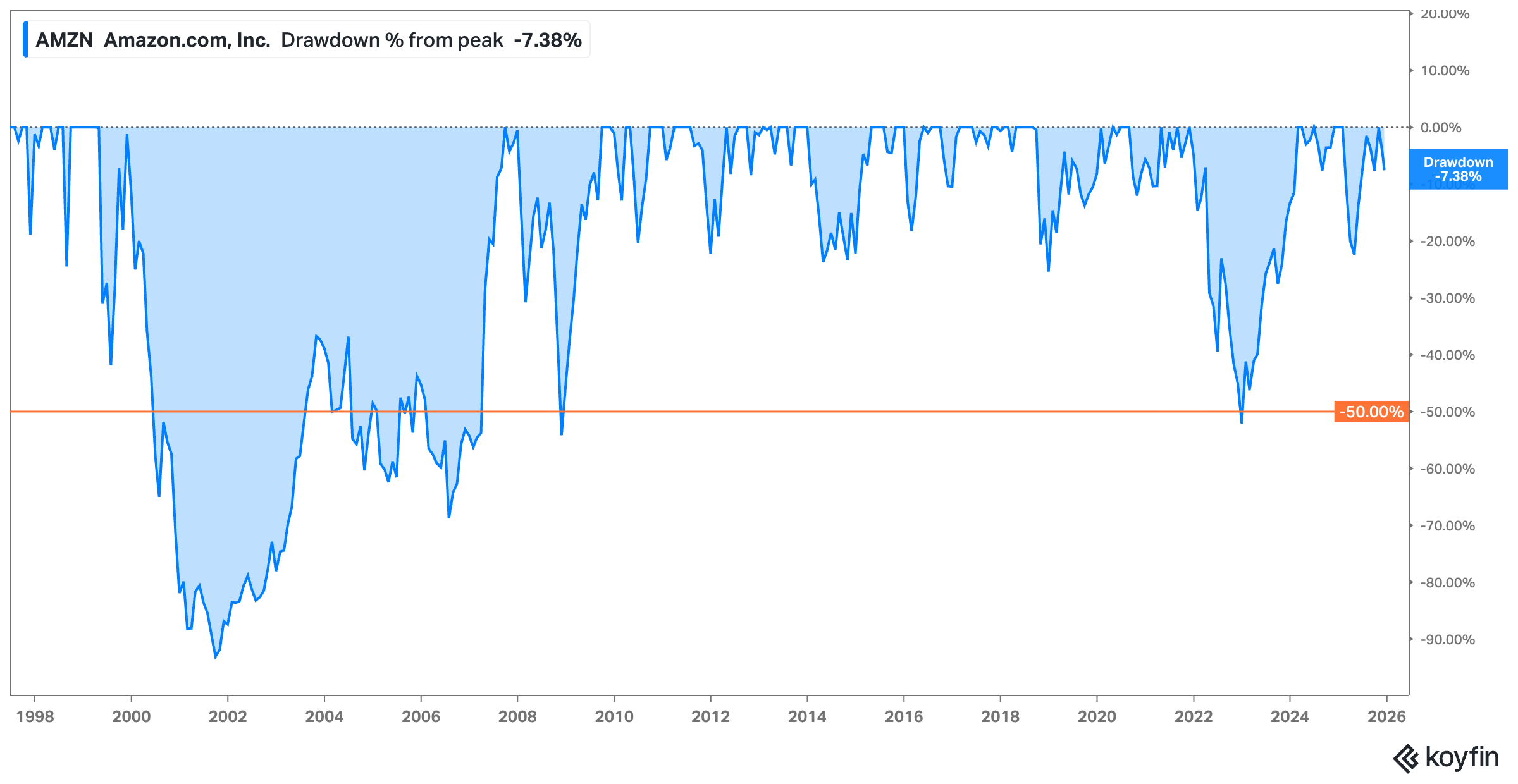

Since breaking out of its IPO base in 1997, $AMZN has delivered a 191,000% return, turning $10,000 into roughly $19 million.

Here’s the daily chart highlighting its IPO base breakout.

And monsterous 3M chart. Winners win.

However - these investors, had they held, would’ve experienced multiple 50% drawdowns, including a 93% drawdown in 2001.

Investing in growth stocks is not for the faint of heart. This is why we stack layers of probability and meticulously manage risk.

The Amazon Playbook

Amazon succeeded because it combined four rare advantages.

Customer Obsession

Decisions were framed around customer experience, not competitors or quarterly margins.

Relentless Reinvestment

Low margins were intentional. Capital was recycled into logistics, infrastructure, and optionality.

Platform Thinking

Amazon didn’t just sell products. It built rails others could build on.

Time Horizon Arbitrage

Most companies cannot tolerate years of suppressed earnings. Amazon could, and did.

Why Amazon Is Primed For The Future

Amazon is often framed as a mature retailer or a fully valued cloud business. That framing misses the point.

Amazon is primed to thrive because it sits at the confluence of automation, logistics, and compute. Three trends compressing time across the global economy.

Inside its fulfillment network, Amazon already operates one of the largest robotics fleets in the world. Automation isn’t a pilot program. It’s embedded infrastructure, quietly improving speed, efficiency, and unit economics with every iteration.

In the air and on the ground, Amazon continues to invest in autonomous delivery. Drones, routing software, and last-mile automation aren’t science projects. They reinforce the same customer behaviors Bezos identified early: faster delivery wins.

AWS gives Amazon leverage where it matters most. As AI workloads scale, Amazon is both a provider of compute and a user of intelligence — optimizing inventory, pricing, routing, and labor across a global system.

Advertising benefits from this flywheel as well. Amazon sits closest to purchase intent, where discovery turns into action.

Robots move goods. Drones compress time. AI coordinates everything.

Amazon doesn’t need to reinvent itself for the future.

It was designed for it.

The Long View

Amazon didn’t win by being early.

It won by understanding what wouldn’t change, and building relentlessly around it.

While others optimized for quarters, Amazon optimized for decades.

While competitors chased margins, Amazon built infrastructure.

Today, it powers commerce, compute, logistics, and increasingly, intelligence itself.

Amazon is no longer a retailer competing in markets.

It is the infrastructure that markets run on.

Disclosure: This is not financial advice.