Cash Is A Position

Good evening, friends. Happy Sunday.

Last Friday was something else… Stocks got wacked as Trump imposed a 100% tariff on China. The S&P 500 tumbled -2.70%. The Qs closed 24 points below its intraday high. And crypto witnessed the “largest liquidation event in history.”

The sell-off was “out of character” from the uptrend we’ve come to know.

The heavy uptick in volume, accompanied by stocks closing at or near their intraday lows, has me believe that a rapid return to all-time highs is not the path of least resistance.

How low do we go? Who knows.

Here’s the daily S&P 500 chart. Highest daily volume since April 10th.

The “buy everything” market is on hiatus, at least for now.

The Portfolio

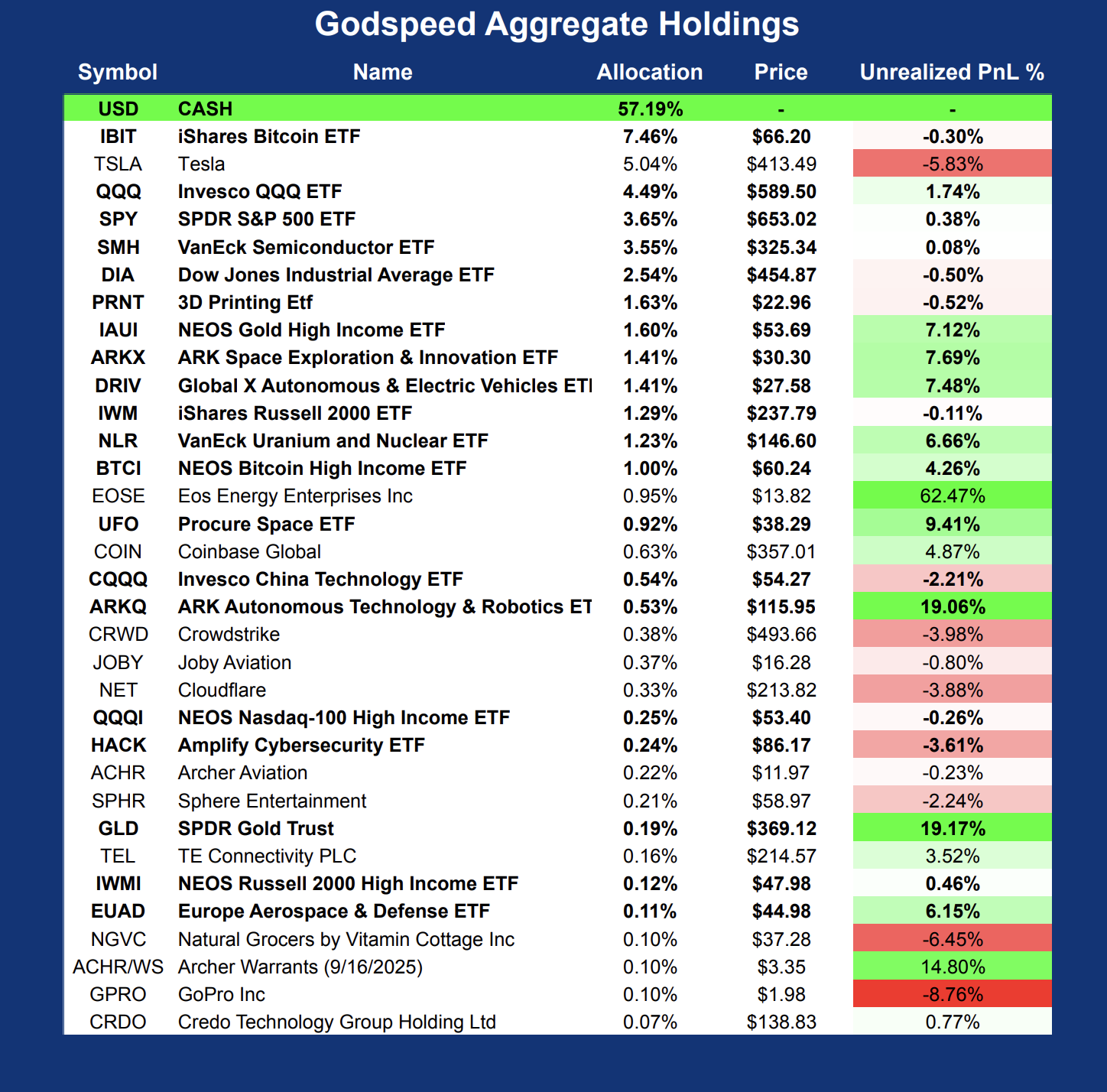

On Friday, I fled to cash. Here’s a live look at my holdings.

I cut the majority of my single-stock exposure and have maintained positions in select thematic ETFs.

Over the coming weeks, the strongest themes will reveal themselves. The strongest stocks will weather the storm. Patience will pay.

I am in no rush to deploy my cash reserves. Remember - my first priority is the protection of capital. I want to be armed and ready for when the time is ripe to allocate risk.

Earnings season is just around the corner. The banks go this week. And there will be an abundance of opportunities as companies report.

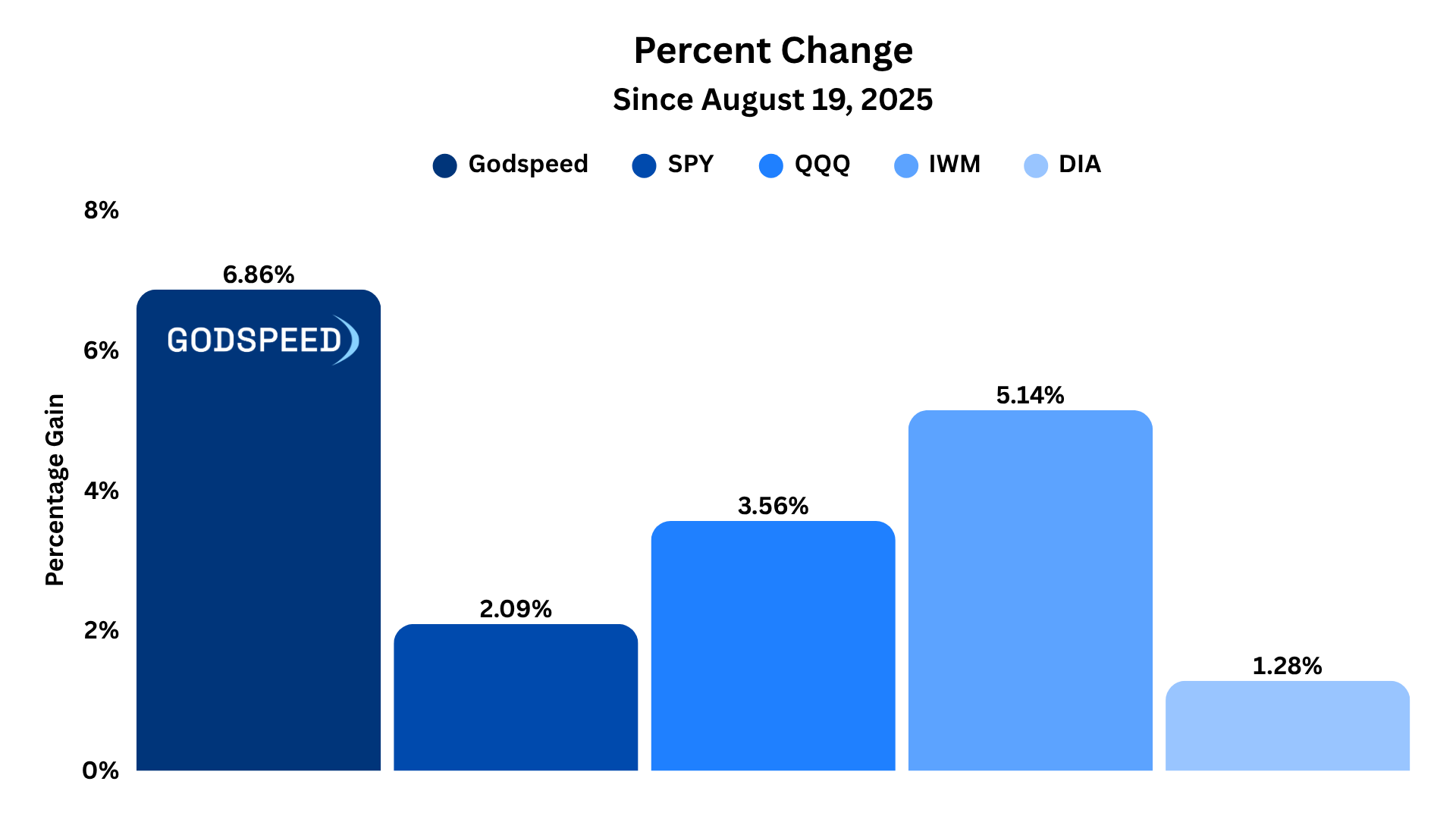

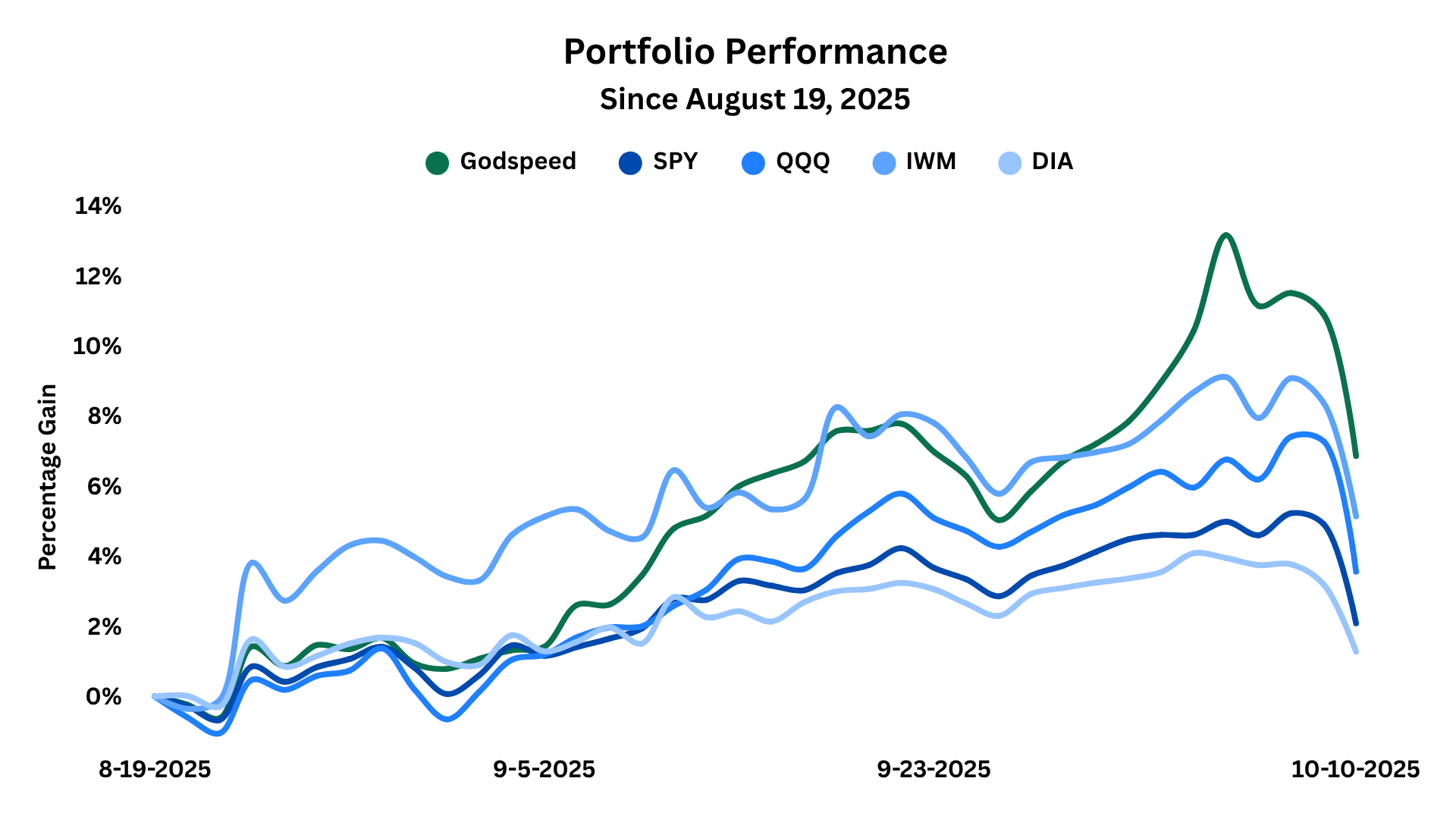

I am grateful to have maintained my outperformance relative to the major indices, but we’re 5.5% below our high watermark. The damage is done. We have work to do. Let’s be responsible.

Here’s the portfolio performance since August 19th.

And equity line chart. Having fun yet…? lol

Themes To Watch

I’ve talked ad nauseam about the 4 pillars of a paradigm shift — Communications, Energy, Manufacturing and Transportation. Within these buckets, we’re seeing signs of relative strength.

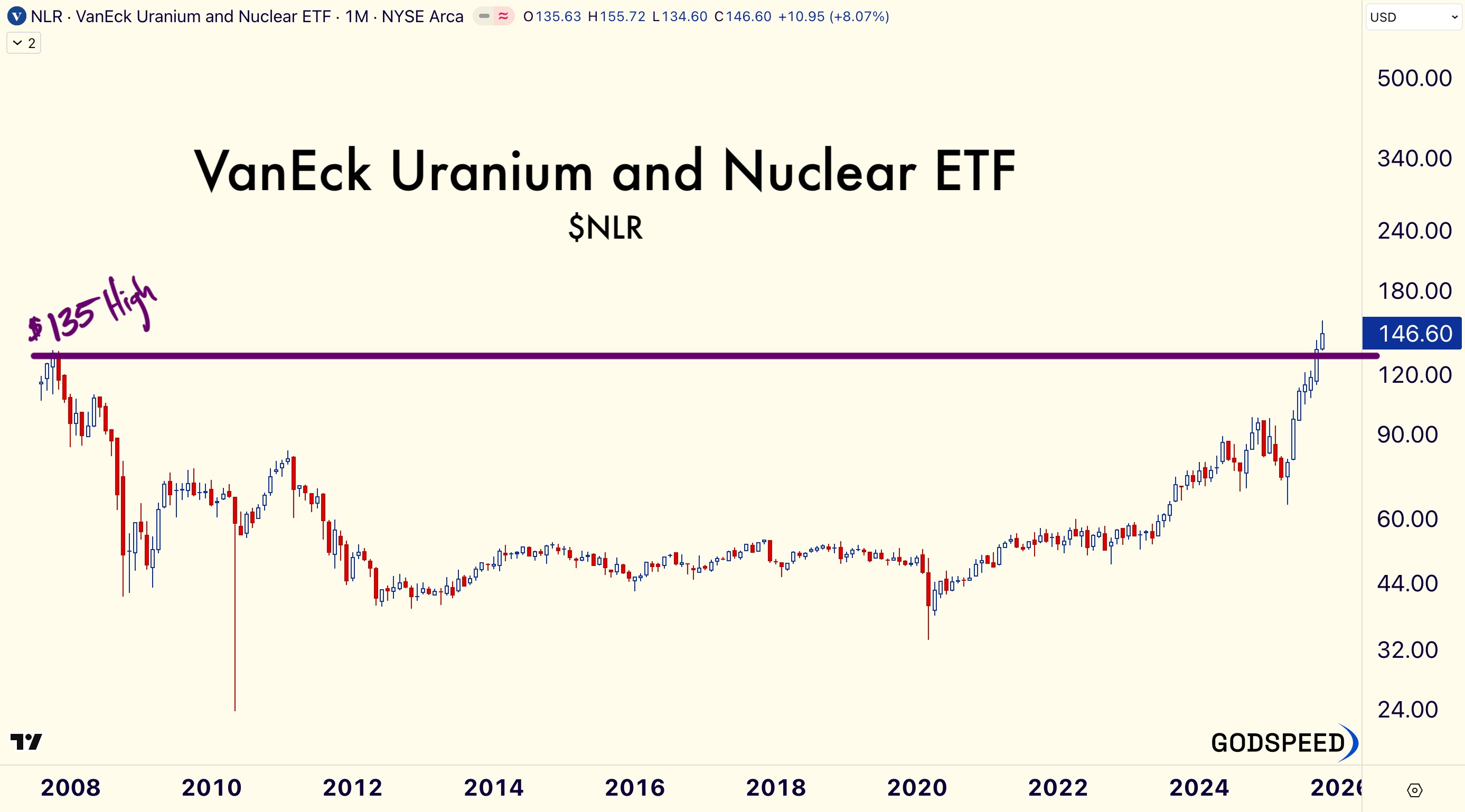

Nuclear and Uranium continue to cook. As long as VanEck’s Uranium and Nuclear ETF $NLR holds 135 (2007 high) the Nuclear Renaissance remains true.

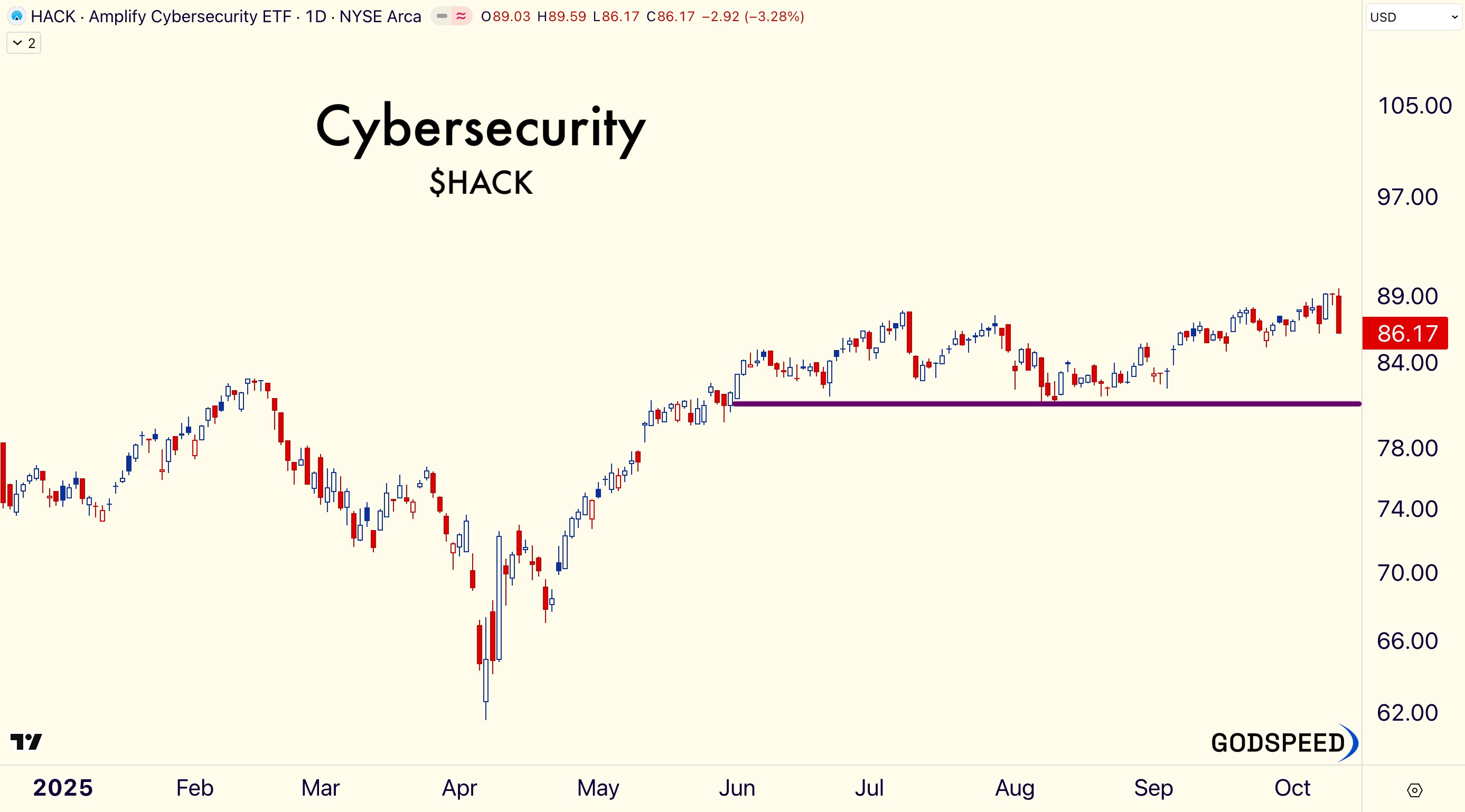

Cybersecurity is a top priority. Amplifies’ First Cybersecurity ETF $HACK cracked -3.28% Friday, but has maintained its primary uptrend. If we break below 81, all bets are off.

Here’s the daily chart.

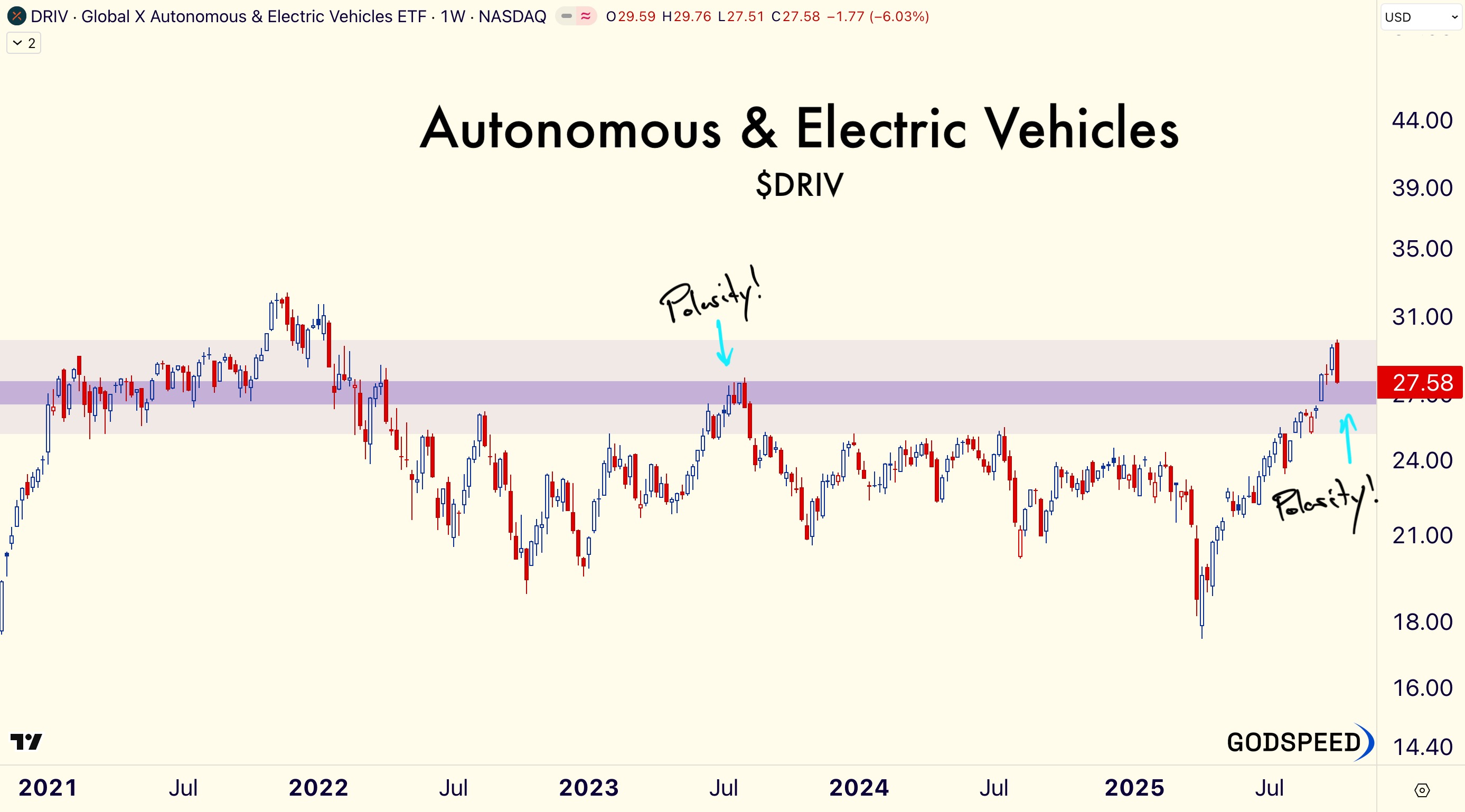

Autonomous Driving is not going away as Waymo and Tesla battle for pole position in the robotaxi race. Here’s a great resource to track their progress: Robo Tracker.

I’ve used the Global X Autonomous & Electric Vehicles ETF as a proxy for this trend. $DRIV dropped -5% Friday. I’d love to see it hold above 26.50 and create a buyable base.

Notice how price returned to its July 2023 high. That’s polarity!

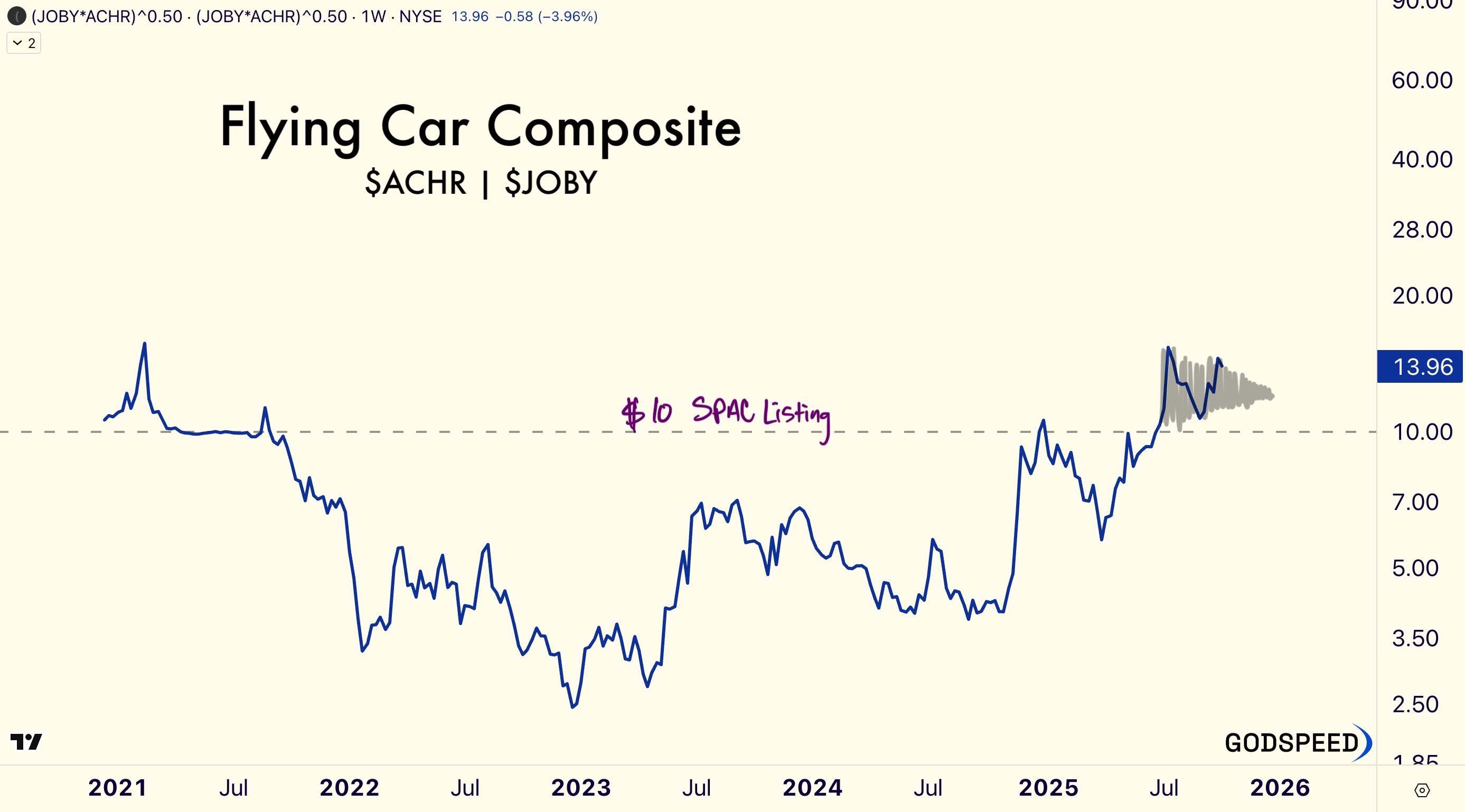

eVTOLs are nearing FAA Type Certification and it appears to be another two horse race. If we look at an equally-weighted composite featuring Joby Aviation and Archer Aviation we can see a flag forming above the SPAC listing price.

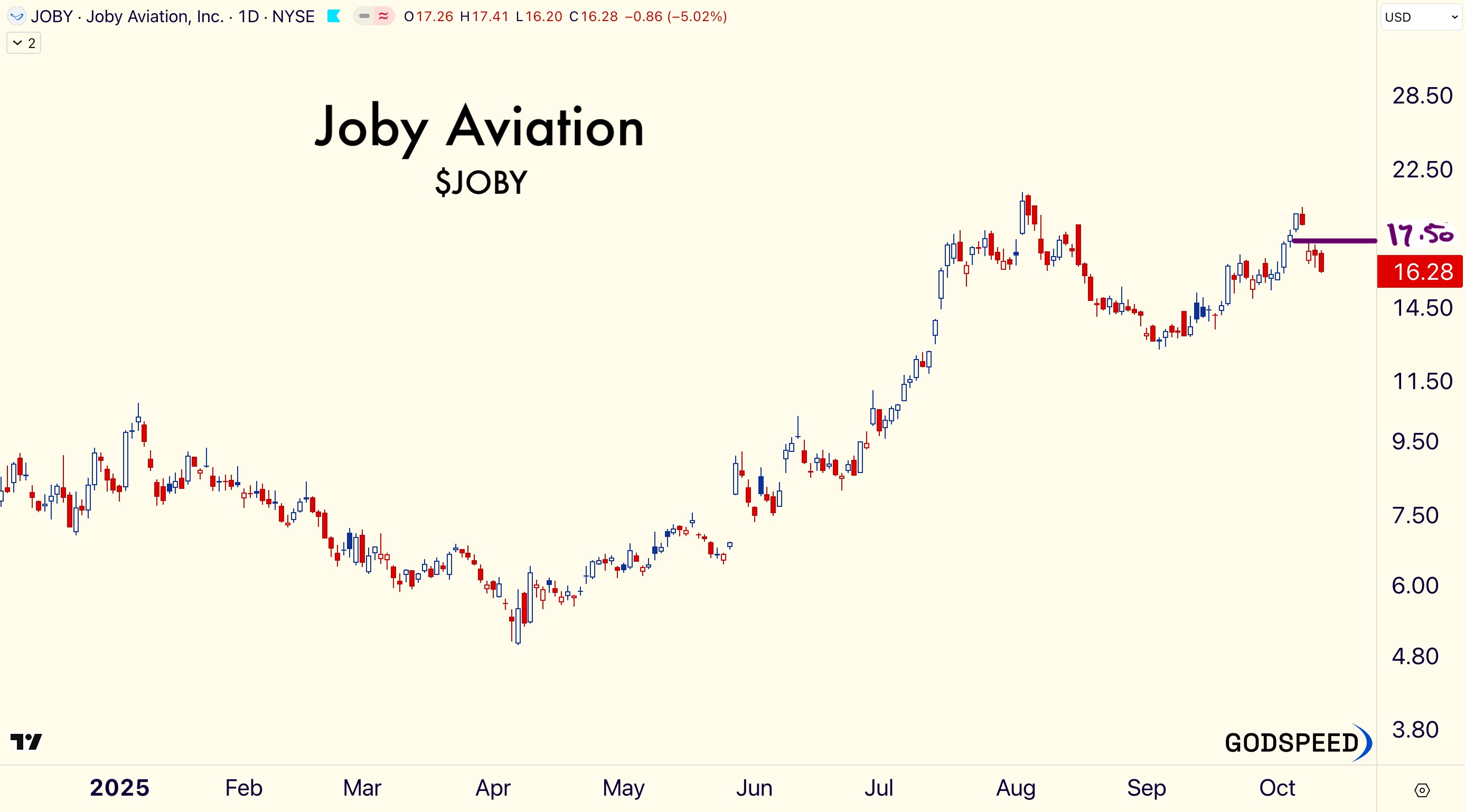

$JOBY needs to reclaim $17.50 before we scale in.

And $ACHR is on the verge of breaking out to all-time highs. If it's above $13, the path of least resistance is to the upside.

The Chinese eVTOL manufacturer EHang Holdings intends to unveil its autonomous, long-range air taxi, VT35. We wish them the best of luck… and be sure to keep an eye on the stock.

If EHang can excite investors, the VT35 may be the catalyst needed to break out of its 2+ year base.

Robots are coming… and I suspect they will be a MAJOR theme in 2026.

This week, Figure introduced its 3rd generation humanoid. And Tesla continues to tease with its Optimus offering. Serve Robotics is on track to roll out 2,000 robots in 2025.

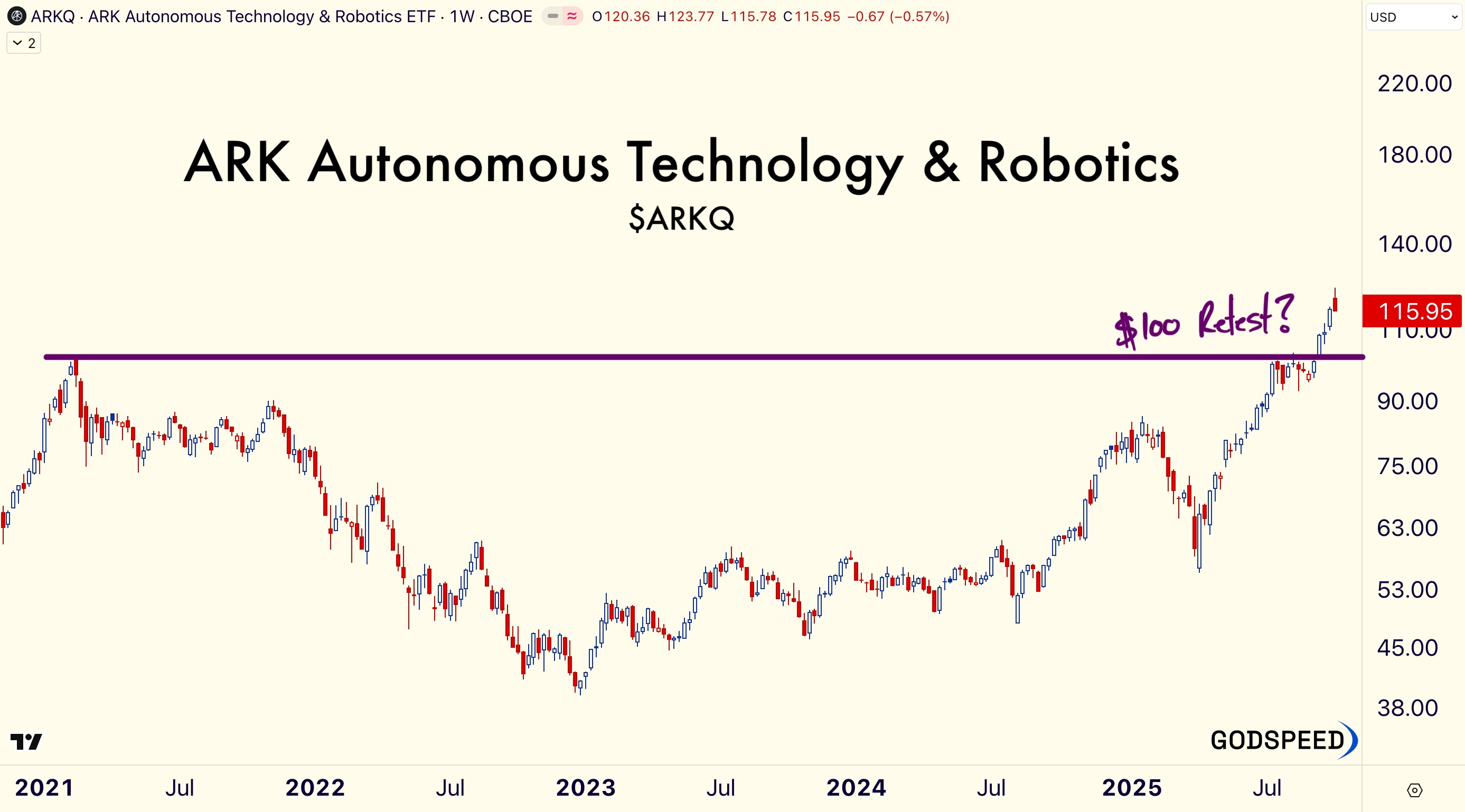

ARK’s Autonomous Technology & Robotics ETF $ARKQ was one of the strongest thematic ETFs going into Friday. $ARKQ fell -4.73%. If the selling pressure continues, the ETF may tick support at $100.

I almost forgot about CHINA. How could I forget? Silly me. China seems to lead in autonomous AND robotics technology. I like Invesco’s China Technology ETF $CQQQ as a proxy.

The ETF collapsed -7.80%, but is still well above its $50 pivot. I suspect a move to all-time highs if China is truly leading autonomous and robotics technology. Tell will tell…

I continue to hunt for relative strength and will share my findings. Until then. Be safe.

Godspeed,

Riley Rosebee.

Disclosure: This is not financial advice.