Let’s Get Back To Business

Good morning Friends,

I’m so grateful for my time away from tech, but it feels great to be back! Money never sleeps. Check out this photo of Wall Street in the West. ;)

Back to business. I shared a live look at my portfolio on Sunday. If you missed the post, see it here.

Since I left y’all on Sunday, a lot has changed, but the AI trade continues to rage. Here are the highlights of the week thus far.

OpenAI x AMD

On Monday, Advanced Micro Devices and OpenAI agreed to a strategic partnership. OpenAI will deploy up to 6 gigawatts of AMD’s Instinct MI450 chips, starting with a single gigawatt in Q3 // Q4 2026. If the partnership is successful, OpenAI may earn up to a 10% stake in AMD. Read the official press release here.

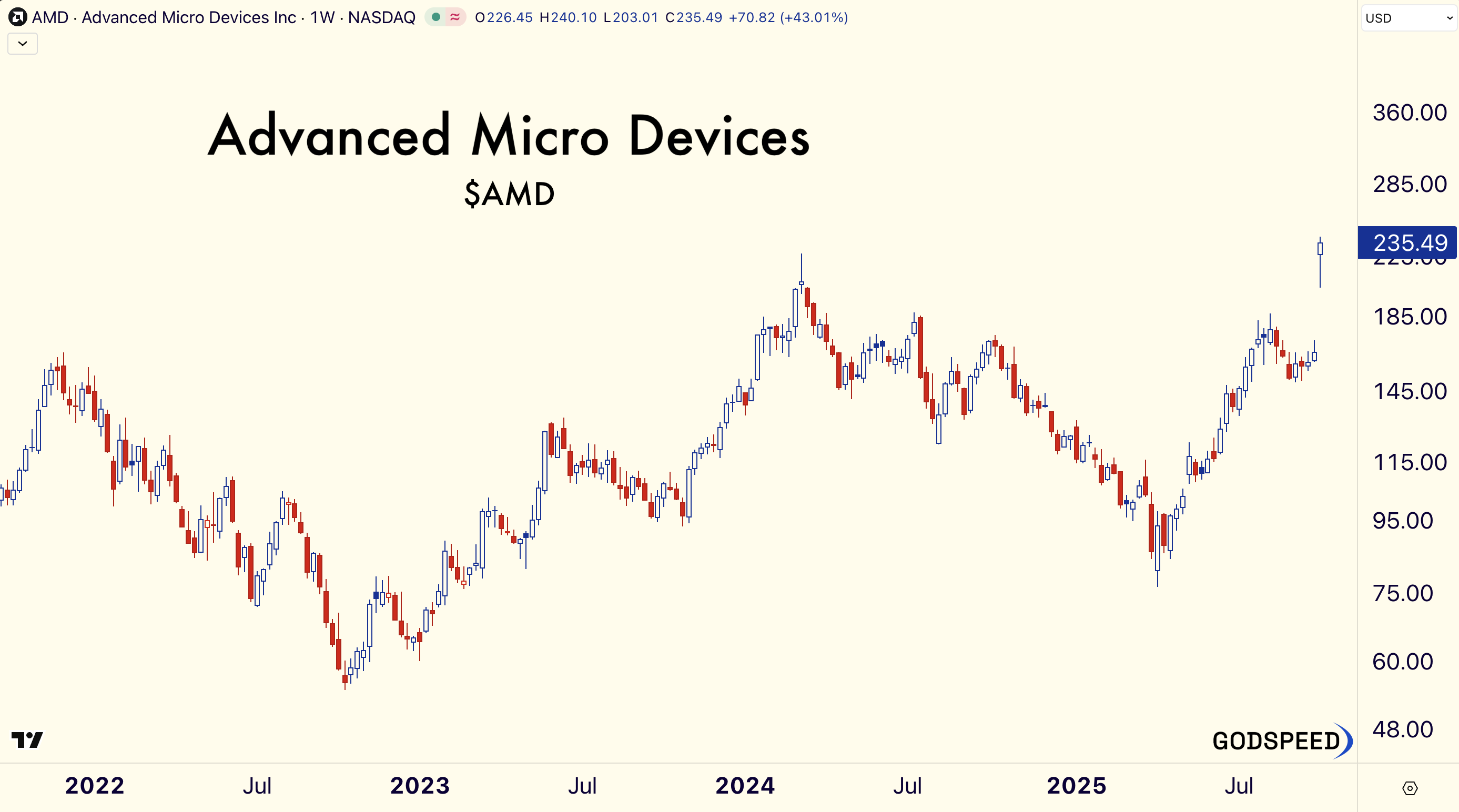

$AMD gained +23% following the news. On Wednesday, the stock closed at an all-time high. Here’s the wild weekly chart.

Talking Tesla

Tesla unveiled its latest “affordable” versions of its best-selling Model Y SUV and Model 3 sedan. The company also shipped FSD Supervised v14.1, featuring a 10x larger AI model, smoother driving, sharper handling of edge cases, and a robotaxi-style drop-off option - a subtle update with significant implications for autonomy. Here are some community-generated first impressions.

$TSLA continues to hold steady above $400. I don’t mind a little sideways action before a break to all-time highs. Here’s the daily chart.

eVTOL Updates

The American eVTOL makers, Joby Aviation and Archer Aviation, continue to captivate me. Both companies showcased their innovative aircraft at the California Air Show in Salinas. See the flights here 👉 Joby Aviation | Archer Aviation.

Tuesday after the close, Joby announced the sale of 30.5M shares at $16.85, resulting in $513.9M. The company will use the cash to fund its FAA certification and aircraft manufacturing efforts, prepare for commercial air taxi operations, and for other “general corporate purposes.” The stock dropped -8% on news of the sale. I’m watching Wednesday’s low of $16.65 as my new line in the sand. If buyers protect this level, the path of least resistance is to the upside.

Archer Aviation made headlines of its own. The company partnered with Cleveland Clinic Abu Dhabi to build the UAE’s first hospital-based vertiport to support both patient travel and time-critical organ transport using Archer’s Midnight aircraft.

$ACHR is a stone’s throw away from all-time highs. Here’s the daily chart.

Let’s not count China out of the eVTOL arms race. EHang Holdings is set to debut its autonomous aircraft on October 13th.

There is a lack of media coverage of this event. We’ll see how the stock reacts. $EH has been a hot mess. Perhaps this debut will be a launch catalyst. Here’s the weekly chart.

Rocket Lab Is Ready For Launch

Rocket Lab locked in an October 14 launch window in New Zealand for “Owl New World,” which will deploy Synspective’s seventh StriX satellite. The StriX is part of a synthetic aperture radar (SAR) constellation, satellites that can capture high-resolution images of the Earth day or night, through clouds and weather. It marks $RKLB’s 15th launch this year and 73rd since the company’s inception, and the first in a 21-mission campaign to build out Synspective’s fleet by the end of the decade.

Rocket Lab also signed a new deal with iQPS, adding three Electron launches starting in 2026. Each will deliver a single SAR satellite to orbit using Rocket Lab’s Motorized Lightband, a precision separation system that gives satellites a clean, controlled deployment.

Folks - we’re witnessing vertical integration in the space economy. What a time to be alive!

$RKLB has literally been a rocket. The stock is up more than 160% YTD and trades at an all-time high.

Serve Robotics x DoorDash

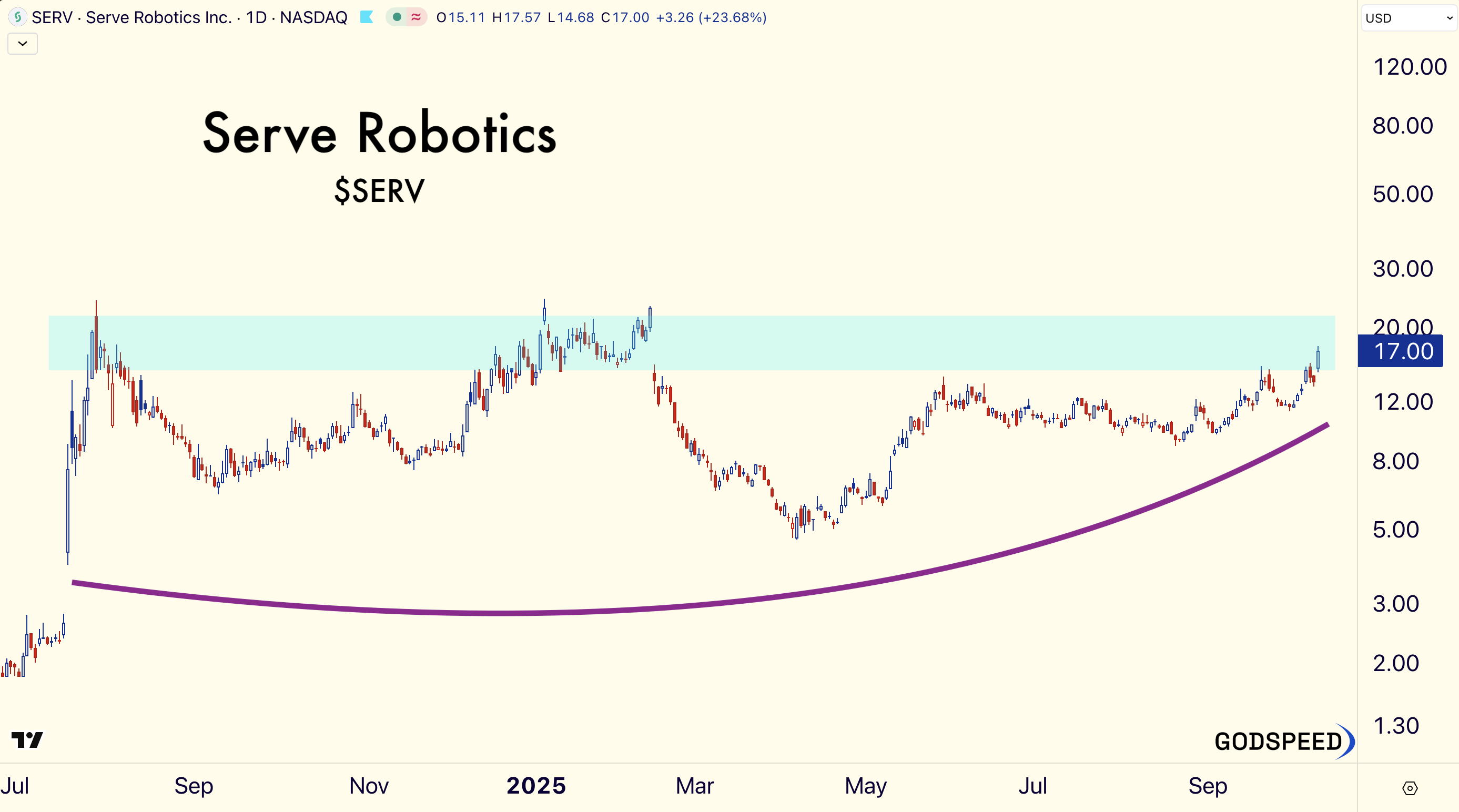

Serve Robotics announced a partnership with DoorDash to bring its autonomous sidewalk delivery robots to DoorDash’s platform, beginning in Los Angeles with plans to expand nationwide. This agreement comes days after Serve celebrated the deployment of its 1,000 autonomous delivery robots. The company remains on track to surpass its goal of 2,000 AI-powered delivery robots by year's end.

$SERV is up 20%. I’m nibbling into $SERV as long as the stock holds above 14.44.

Woof - I know I shared a lot of info. I hope it helps build conviction in your market participation.

Disclosure: This is not financial advice.