What A Run 📈

Good morning, and happy Sunday, friends!

The markets are on some run. My equity curve carves out all-time highs like it's Thanksgiving. *that’s a turkey joke, folks*

I want to take this opportunity to share an inside look at how I’ve navigated these waters. The figures below reflect real assets. This is not a paper portfolio.

But before we get into the good stuff, I want to be clear — my primary objective as an asset allocator is to protect assets. The secondary goal is growth. Let’s not get that twisted… growth is secondary. Because if we fail to protect, we fail to grow.

Let’s go!

Like I said, it’s been a fun run.

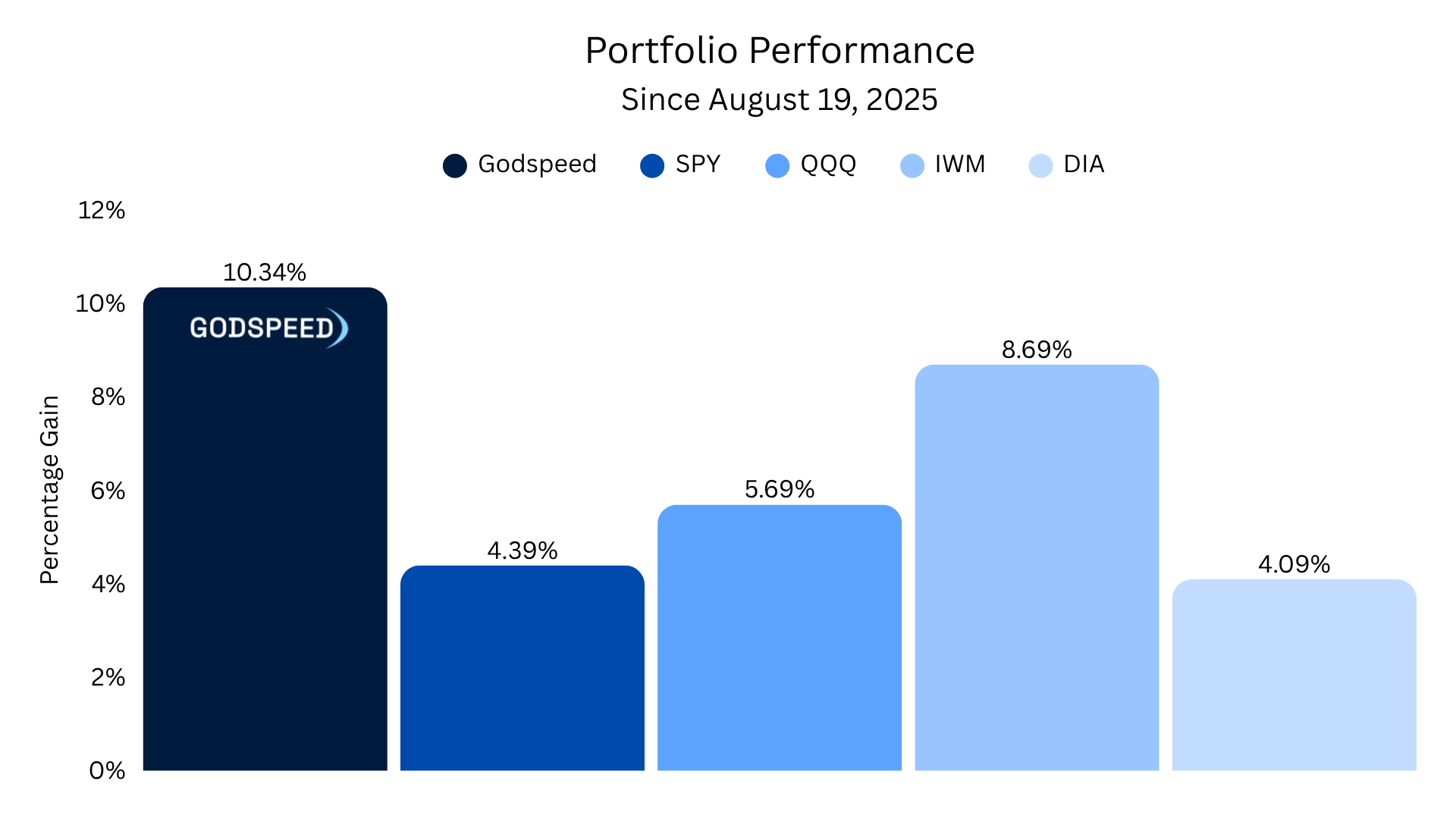

The Godspeed Portfolio is up +10.34% since August 19th - outperforming the benchmark, broad market index ETFs — SPY, QQQ, IWM and DIA. Here’s the performance breakdown.

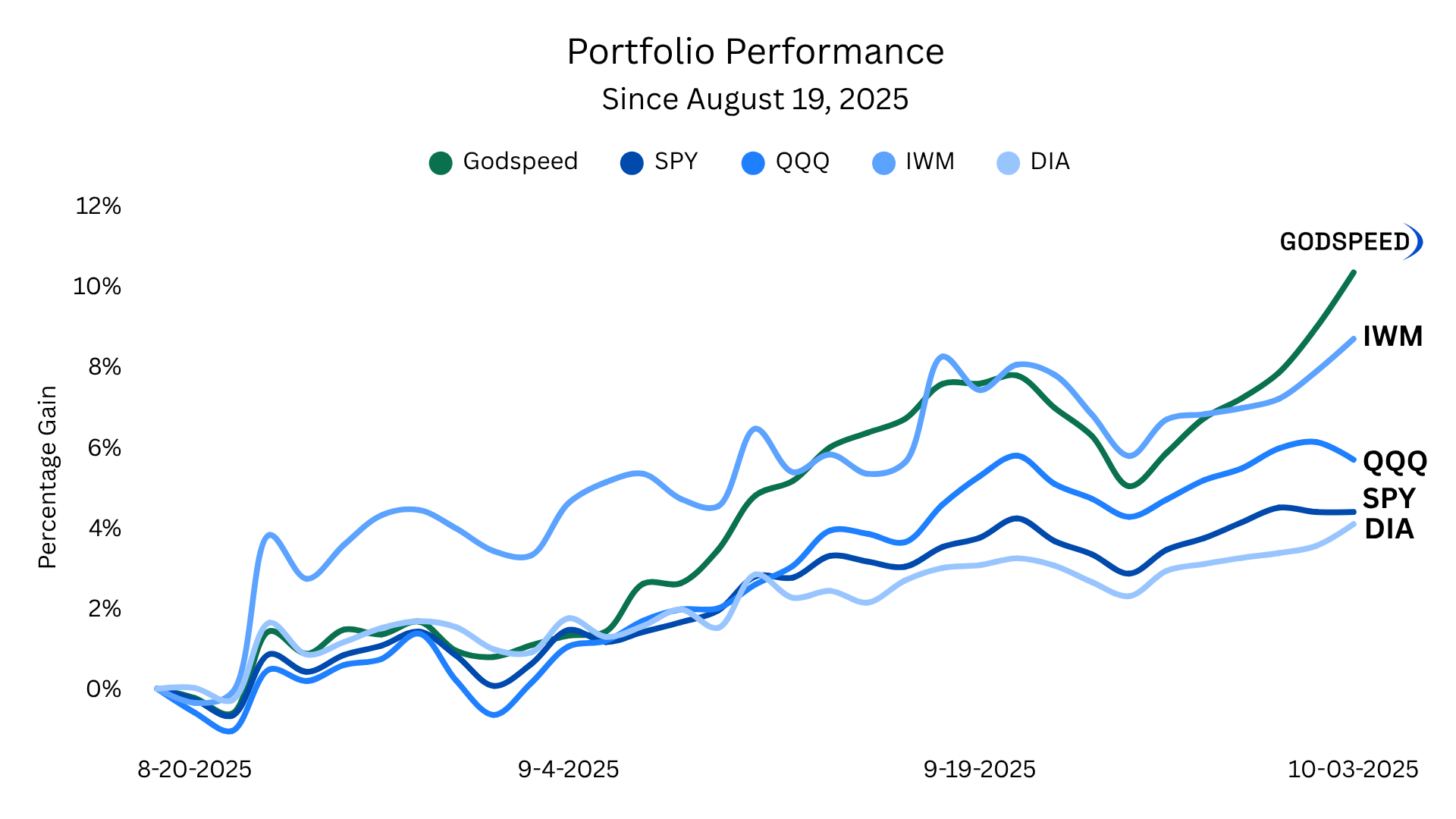

And a line chart depicting the daily equity curves.

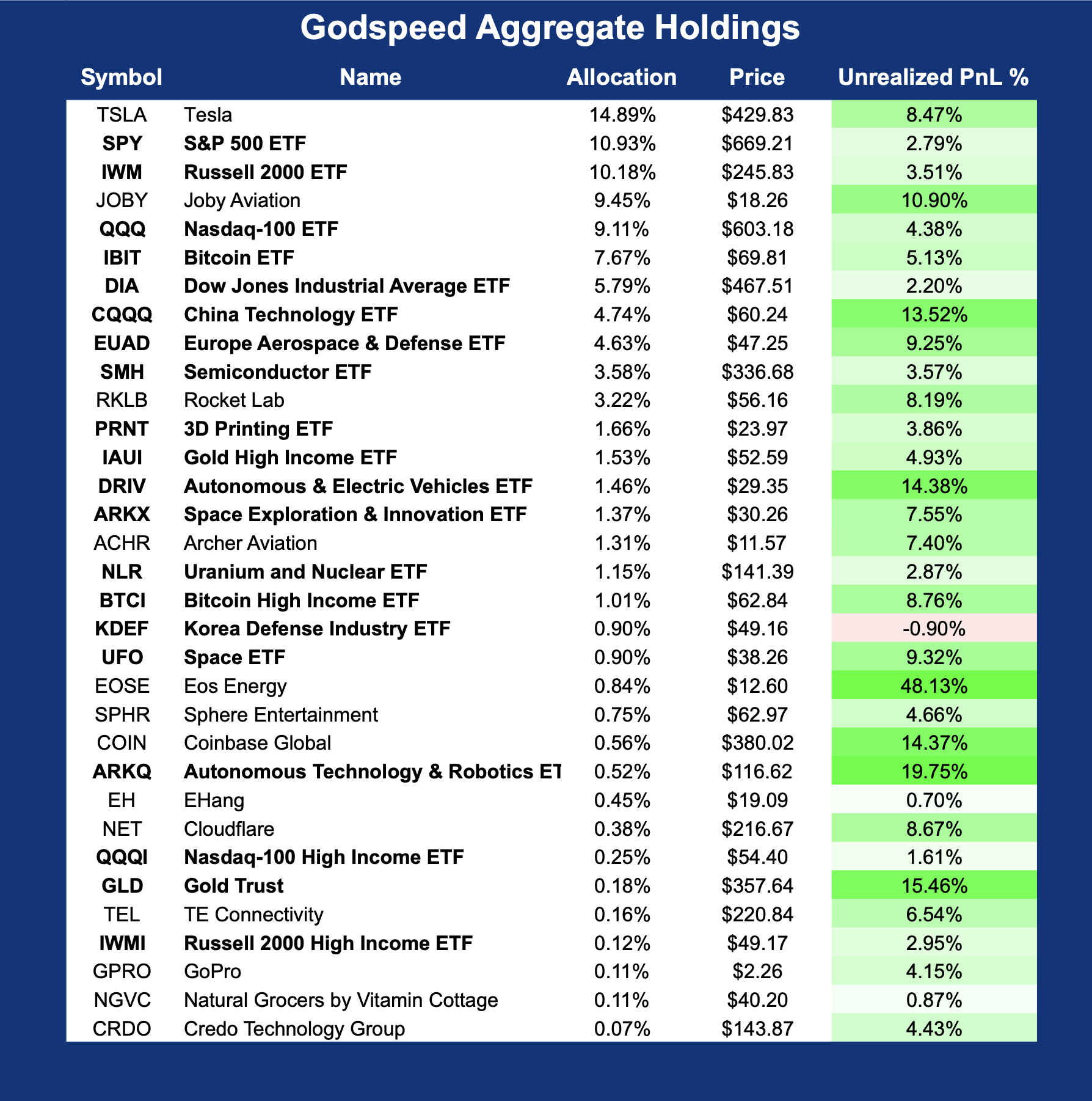

If you’re wondering what I hold, have a look.

The portfolio is top heavy, yes.

The top-10 positions represent 80% of the total assets. And if you count, 67% of the capital is allocated in ETFs.

Let me add a little color as to my approach —

I first allocate to the broad market. I want to feel the wind at our back. Life is too short to fight a trendless tape.

If the broad market moves in our favor, I find relative strength in sector + thematic ETFs. These baskets allow me to bet on a developing trend while mitigating company-specific risk.

If the broad market + theme behaves appropriately, I go on the hunt for single stocks. This is my top down approach.

Tesla and Joby Aviation are my two largest single-stocks, making up 25% of the portfolio.

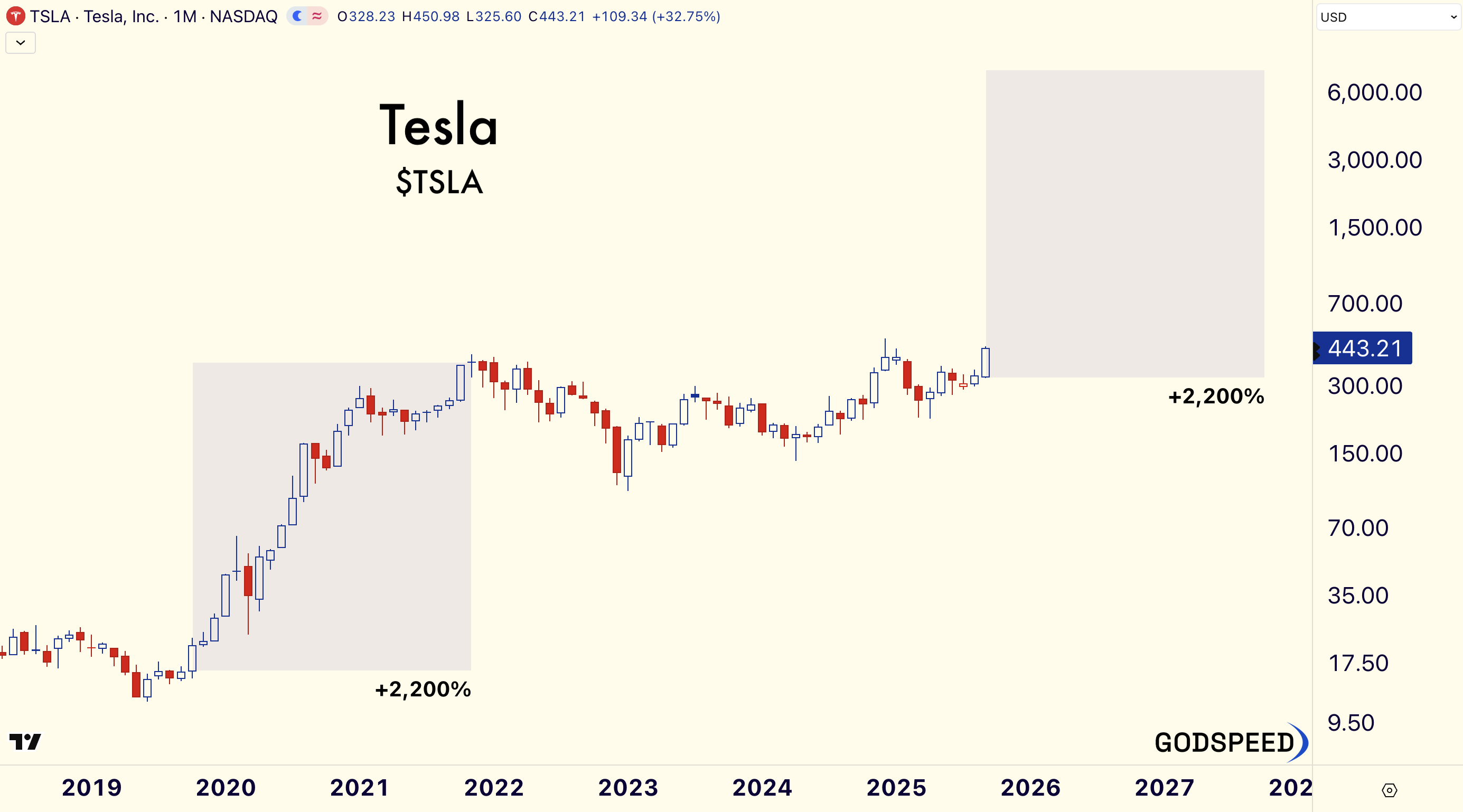

Tesla is at the epicenter of the AI-enabled paradigm shift. We’ve tracked the narrative all year. The company is teasing a household humanoid and seeks to remove its Robotaxi safety drivers before the end of 2025. The stock is up 90% since its April 8th low close.

What if it ticks $7,000? Is a measured move out of the question? $TSLA is known to trade like a memestock. Allocate accordingly.

As long as $TSLA holds above $370, the path of least resistance is to the upside.

Joby Aviation is the second-largest single stock holding in the Godspeed Portfolio. The company demonstrates its S4 aircraft around the world as innovators and early adopters eagerly await commercial air taxi operations in the UAE and FAA Type Certification in the US.

$JOBY is up 240% off its April 4th low close. Check out how the stock popped off its former highs in early September. That’s polarity.

I’m long $JOBY above $14.44. Are you ready for the next leg higher?

I’m actively building into Rocket Lab. On Friday, $RKLB closed at an all-time high on above average volume. The company is a vertically-integrated space service provider and aims to successfully launch its Neutron rocket in late-2025. The Neutron is reusable and directly competes with SpaceX’s Falcon 9 rocket. The friendly competition is great for the New Age private space race.

$RKLB is shooting for the stars. If it falls below 45, all bets are off.

Folks - I’m logging offline for the next few days. I don’t think I’ve spent 72 consecutive hours away from the internet since 2022. I’m long overdue for some time away from tech.

I’ll be rafting down the Colorado River, crossing from Colorado into Utah, Ruby Horsethief for those familiar with the area.

It’ll be great to step away from the tape. And I’m excited to see what surprises the market has in store for me when I return. Fingers crossed my stops stay strong.

There’s a great paradox in what we do as traders // investors // asset allocators.

We see our time on-screen “researching” as value-added, productive “work.” But I’ve found that my time away from the endless flow of information allows ideas to germinate and grow organically.

We cannot force a paradigm shift.

Big ideas need time and space to resonate.

Godspeed,

Riley Rosebee

Disclosure: This is not financial advice.