Is It Time To Fly?

Good morning folks -

In recent months, we’ve talked at nauseam about the autonomous mobility arms race between Tesla and Waymo, but mobility is more than just automobiles. Advanced air mobility, by way of eVTOLs, drones, and supersonic jets - is on the cusp of entering our reality.

It’s an exciting time to be alive. Turbulence is to be expected.

Where They Stand

Archer Aviation and Joby Aviation are two American eVTOL manufacturers seeking to reshape our skies.

Joby has cemented itself in pole position. It’s in the 5th and final stage of the FAA’s type certification process. The company will showcase its aircraft at the California International Airshow and EXPO 2025 in Osaka, Japan. Joby targets commercial operations to commence in 2026.

Archer is slightly behind in its type certification process, but aims to launch commercial services in the UAE before full FAA type certification in the US. In its latest test flight, Archer’s Midnight aircraft reached an altitude of 7,000. Archer has yet to announce any demonstration flights or showcase events.

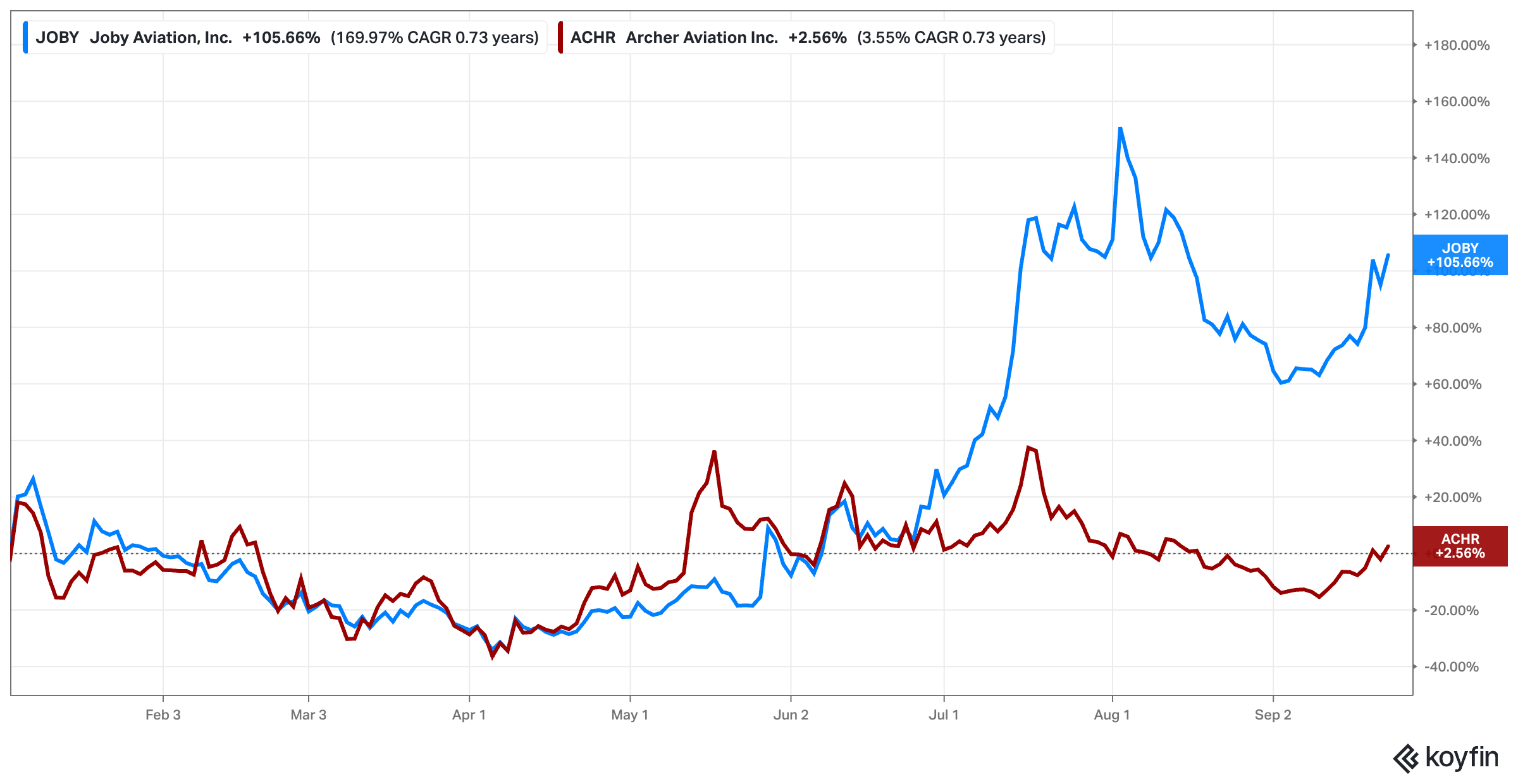

Wall Street has favored $JOBY as the stock is crushing $ACHR year to date.

There are other names in the space — EHang (China), Eve Holdings, Surf Air Mobility and Xpeng (China). However, given the greater risks associated with aviation innovation, I prefer to play the leaders.

Let The Charts Speak

I’m a sucker for relative strength.

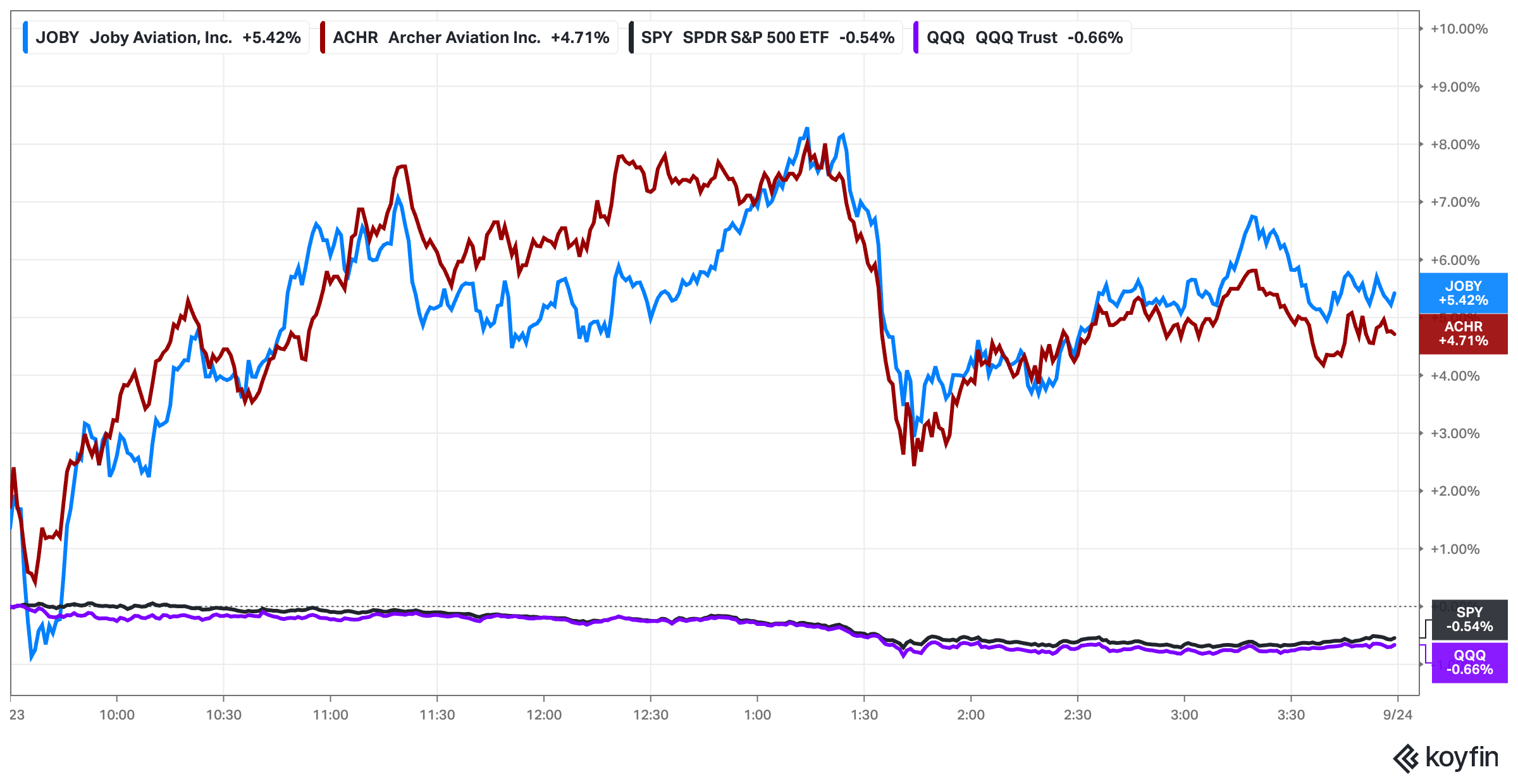

Yesterday, the S&P and Qs fell approx. -0.50%. The eVTOL leaders $JOBY and $ACHR gained +5.42% and +4.71%.

Does one day make a trend?

No.

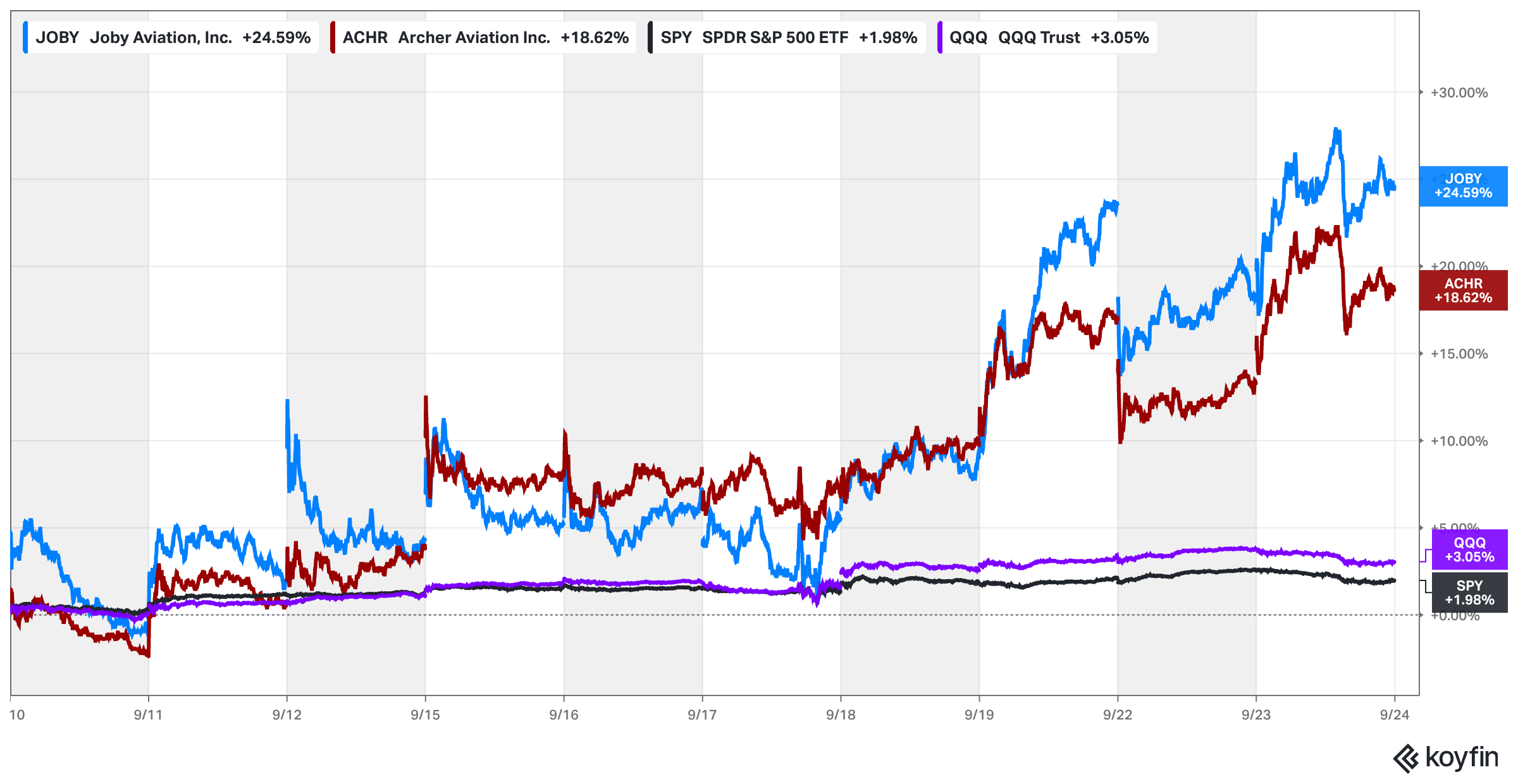

But both $JOBY and $ACHR have displayed signs of high relative strength for more than 10 days.

I’m accumulating $JOBY and nibbling into $ACHR. Join me LIVE today at 5PM ET on Godspeed TV to hear more about my eVTOL investment thesis.

Disclosure: This is not financial advice.