How Apple Advanced 1,600x

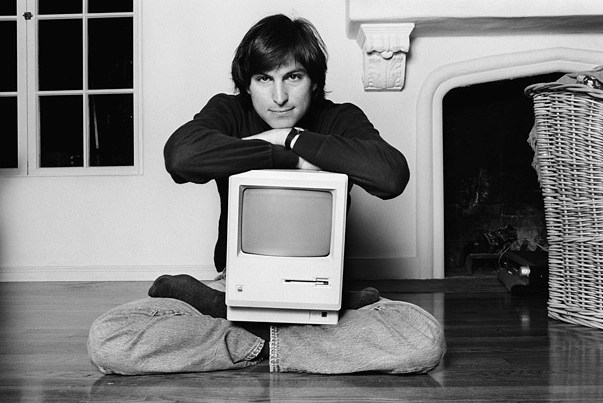

Steve Jobs’ Return — The Spark That Lit a Trillion-Dollar Fire

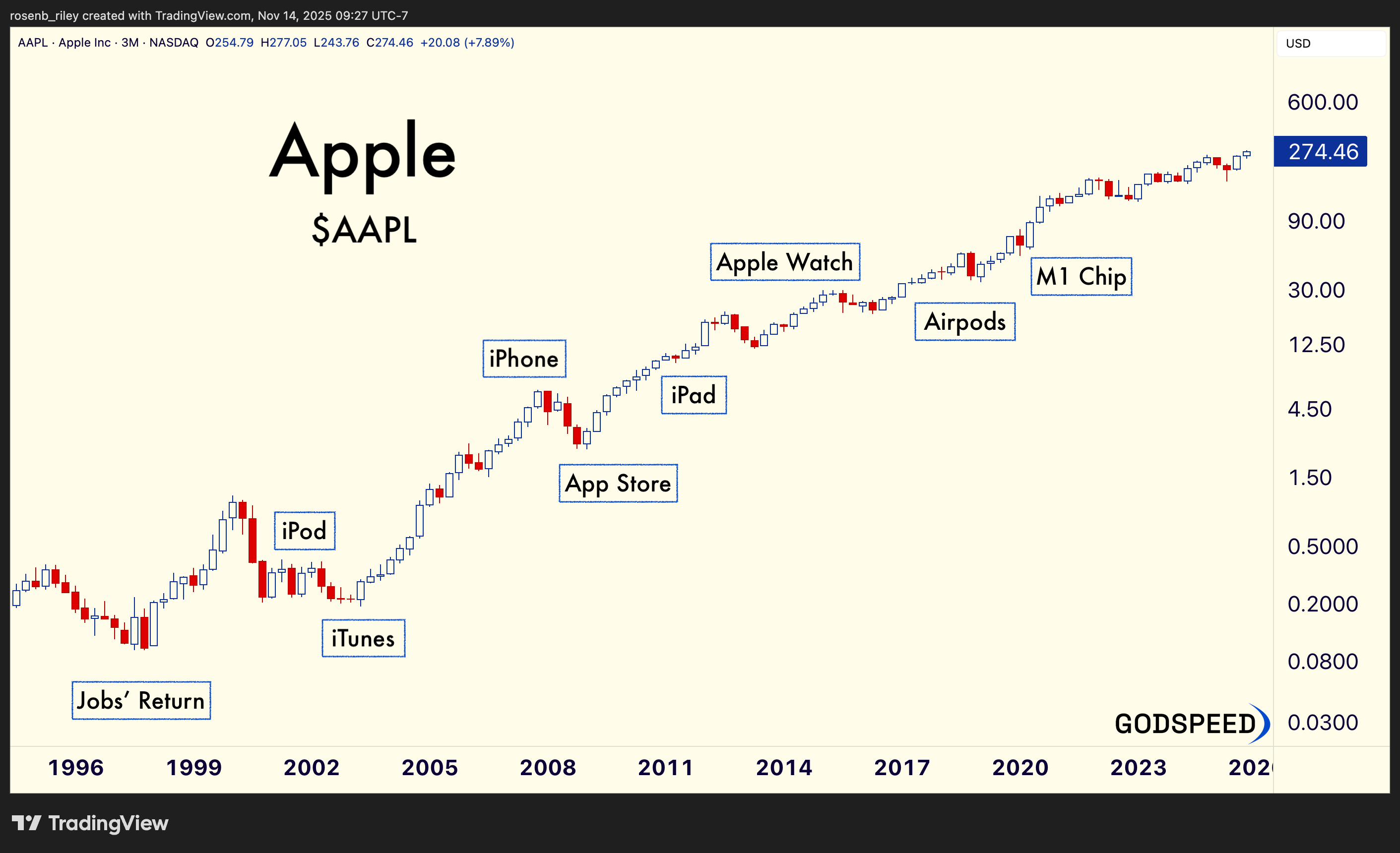

In 1997, Apple was on the brink of bankruptcy. In 2023, it was the first company in history to close with a $3 trillion market cap. This is the story of one of the greatest comeback runs and compounding machines in public markets’ history. The outperformance was powered by relentless innovation, iconic products, and a cult-like following.

In this post, we examine Apple’s transformation from Steve Jobs' return to the present day. We’ll highlight the product breakthroughs, ecosystem expansion, and strategic discipline that led to an outstanding 1,600x return in less than 3 decades. Using frameworks from William O’Neil (CANSLIM) and Nicolas Darvas, we’ll explore why Apple was not just a great company, but a once-in-a-lifetime investment opportunity.

Apple’s Inflection Timeline (1997–2023)

Innovation. Simplicity. Storytelling. A relentless product engine driving exponential returns.

- December 20, 1996 – Apple announces acquisition of NeXT. Steve Jobs returns as advisor.

- September 15, 1997 – Jobs becomes interim CEO; secures $150M investment from Microsoft. Refocuses Apple’s product roadmap.

- August 15, 1998 – iMac G3 launches; 800K+ units sold in 5 months. Apple returns to profitability.

- May 19, 2001 – First Apple Stores open. A bold move toward vertical retail.

- October 23, 2001 – iPod debuts. Music becomes Apple’s second act.

- April 28, 2003 – iTunes Store launches; 1M songs sold in first week.

- January 9, 2007 – iPhone is unveiled at Macworld. Apple drops “Computer” from its name.

- July 10, 2008 – App Store launches with 500 apps. 60M downloads in the first month.

- April 3, 2010 – iPad launches. Over 300K units sold on day one.

- October 5, 2011 – Steve Jobs passes away. Tim Cook leads Apple into its next era.

- September 19, 2014 – iPhone 6 launches. Record sales; Apple Watch unveiled.

- December 13, 2016 – AirPods officially launched. Apple redefines the wireless audio category.

- August 2, 2018 – Apple becomes the world’s first $1T company.

- November 10, 2020 – M1 chip is unveiled. Apple Silicon takes over the Mac.

- January 3, 2022 – Apple ticks $3T market cap intraday.

- June 30, 2023 – Apple closes above $3T for the first time.

The Drivers Behind Apple’s Trillion-Dollar Ascent

1. Product Innovation as a Core Strategy

Apple’s trajectory is defined by product breakthroughs that created and captured entirely new markets. The iMac marked the return to form in the late 1990s. Then came the iPod, which revolutionized digital music. But it was the iPhone in 2007 that redefined Apple’s future and the mobile computing landscape. Each subsequent innovation - the iPad, Apple Watch, AirPods, and Apple Silicon - expanded Apple's reach and deepened its user engagement. These weren’t iterative upgrades; they were category-defining innovations. Each new product acted as a “CANSLIM N” moment, unlocking a new revenue stream, narrative, and phase of investor belief.

2. Ecosystem Flywheel

What made Apple unique wasn’t just the devices. It was the system they operated in. From iTunes and iCloud to Apple Pay and Apple Music, Apple built a vertically integrated ecosystem that made switching painful and loyalty rewarding. With every additional service, the value of being in Apple’s ecosystem increased. By 2025, the company surpassed 1 billion paid subscriptions, a figure that reflects not just market penetration, but the depth of customer lock-in. The ecosystem turned Apple from a hardware company into a services powerhouse with recurring revenue and enviable margins.

3. Operational and Capital Allocation Discipline

Tim Cook brought a masterclass in operational execution. Under his leadership, Apple built the most efficient global supply chain in the world. Product launches became synchronized global events, supported by precise logistics and manufacturing control. Meanwhile, Apple returned massive value to shareholders. Between 2012 and 2023, the company spent over $500 billion on share buybacks, reducing float and boosting EPS dramatically. And when device cycles matured, it was Apple’s high-margin services segment that protected the bottom line. Capital discipline was a quiet but potent contributor to Apple’s stock compounding machine.

4. Brand, Loyalty, and Retail Domination

Apple isn’t just a tech company. It’s a cultural icon. The Apple logo became a badge of identity, and its products were aspirational status symbols. Apple Stores turned retail into an immersive brand experience, offering minimalist design, hands-on demos, and top-tier customer support. This brand resonance gave Apple pricing power, while customer satisfaction and loyalty remained industry-best. The end result? A brand moat that competitors couldn’t touch, and an emotional connection with users that translated into consistent demand.

What CANSLIM Says About Apple

A stock that checked every box, again and again.

CANSLIM Highlights:

- C & A: Massive EPS growth post-iPhone; sustained profitability.

- N: iPhone, App Store, iPad, M1 — each product launch was a breakout.

- S: Share count shrank aggressively; demand soared.

- L: Category leader in phones, tablets, wearables, and services.

- I: Institutional buying surged post-2010. Core holding for many funds.

- M: Rode multiple bull markets and led each one.

Apple Wasn’t Just a Great Company. It Was a Perfect Stock.

Apple’s climb from near death to $3 trillion wasn’t luck. It was a masterclass in:

- Visionary leadership (RIP Steve)

- Relentless product execution

- Vertically integrated technology ecosystem

The takeaway? Greatness compounds. And for investors who spotted the inflection points and navigated the noise, Apple delivered the kind of return most only dream about.

Lest we not forget – Buffett was late, first buying shares in 2016. He still earned over $100B on his trade.

Next in the Godspeed Case Study Series: Nvidia.

Disclosure: This is not financial advice.