How Nvidia Became the Engine of the AI Revolution

The Company That Turned a Graphics Card Into a Global Technology Platform

In the mid-1990s, Nvidia was a small chip startup fighting for survival in the crowded PC graphics market. By 2025, it became one of the fastest-growing and most profitable companies in history — a multi-trillion-dollar giant powering AI, data centers, robotics, gaming, and every major trend in modern computing.

This case study walks through how Nvidia went from “the graphics company” to the backbone of the AI revolution.

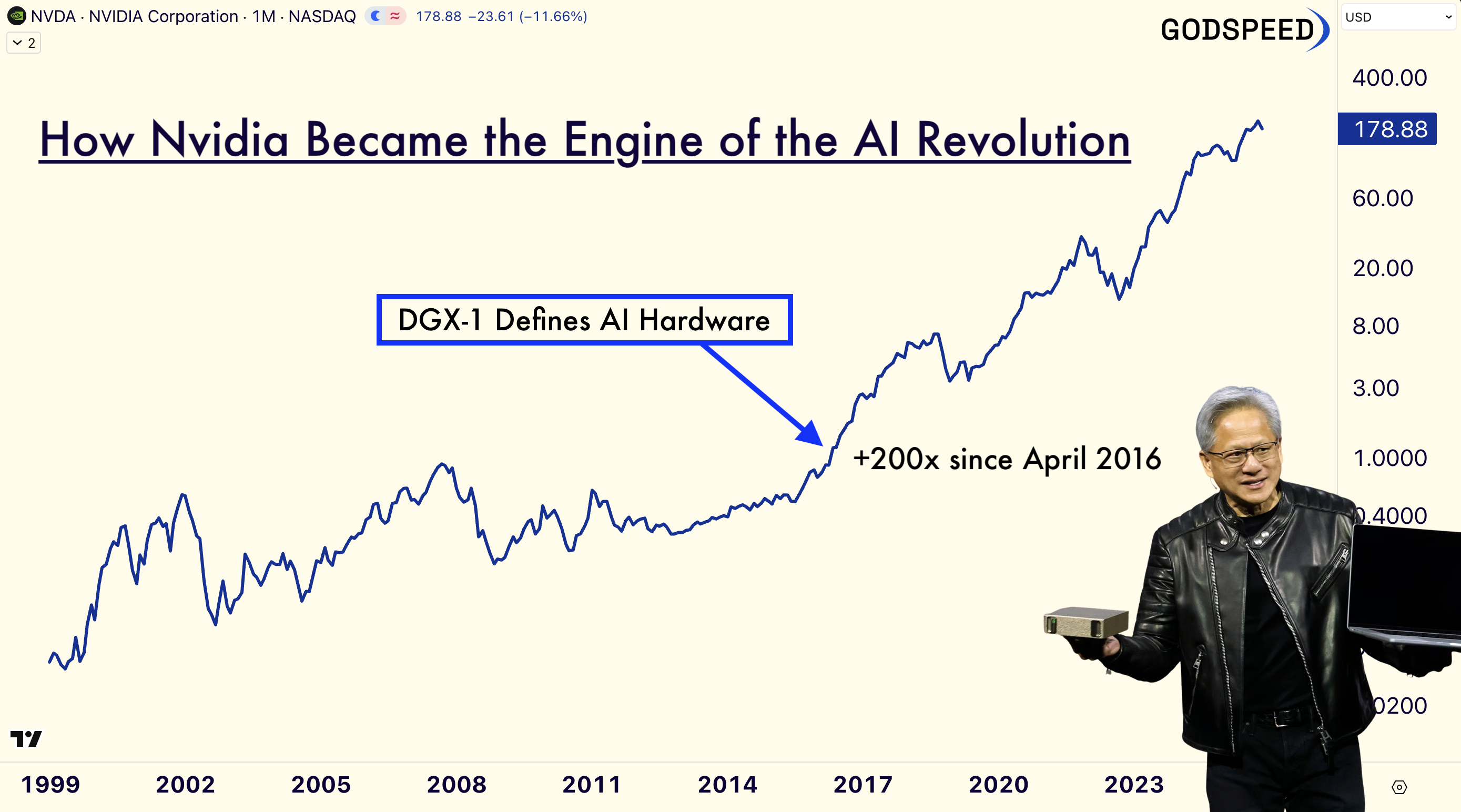

Nvidia’s Inflection Timeline (1993–2025)

1993 — Nvidia is founded

Three engineers bet that graphics chips will shape the future of computing.

1999 — Nvidia invents the GPU + IPOs

GeForce 256 becomes the first modern GPU. Nvidia lists on NASDAQ and begins growing its developer base.

2006 — CUDA launches

A software platform that lets GPUs run general-purpose tasks, not just graphics.

2012 — Deep learning takes off

Researchers train AlexNet on Nvidia GPUs — kick-starting the modern AI boom.

2016 — DGX-1 arrives

Nvidia sells a turnkey “AI supercomputer in a box,” and Big Tech begins standardizing on Nvidia hardware.

2018 — Real-time ray tracing

Turing architecture resets both gaming and professional graphics cycles.

2020 — A100 becomes the AI workhorse

The A100 becomes the default chip for AI training in cloud and research labs.

2021 — Omniverse launches

Nvidia expands into simulation, robotics, and industrial digital twins.

2023 — Nvidia surpasses $1T market cap

AI demand explodes after ChatGPT; Nvidia becomes the center of the AI supply chain.

2024 — Blackwell architecture is unveiled

Next-gen AI chips see historic demand, locking in Nvidia’s leadership for years.

The Drivers Behind Nvidia’s Trillion-Dollar Ascent

Jensen’s Bet: Many Chips Working Together (Parallel Computing)

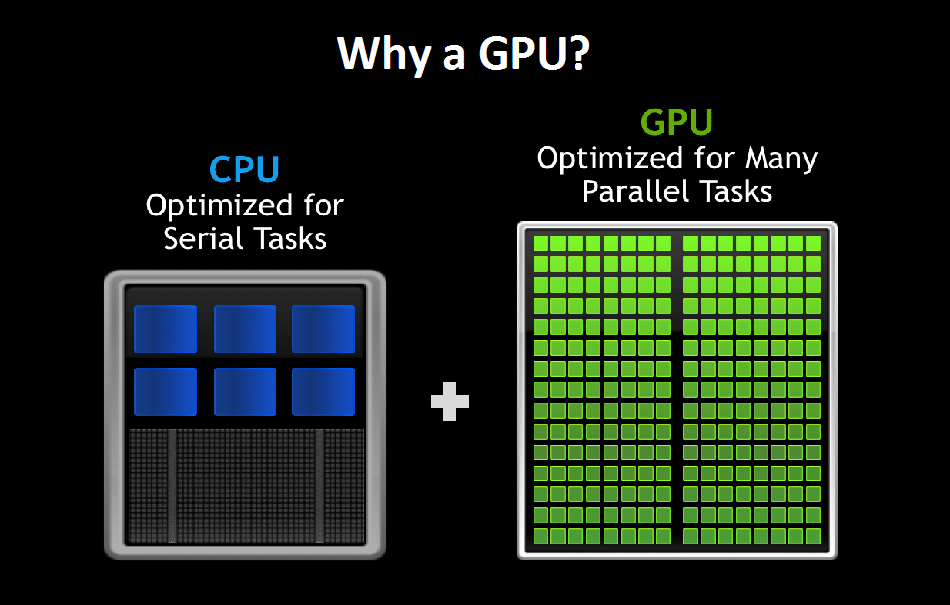

Jensen believed the future of computing wouldn’t rely on a single, fast chip — but thousands of smaller chips working in parallel.

This idea became Nvidia’s religion.

Originally built to render video games, Nvidia’s GPU evolved into the perfect engine for complex tasks like AI, robotics, and autonomous vehicles.

GeForce → CUDA → Tesla → DGX → Hopper → Blackwell

Each new generation expanded Nvidia’s reach, turning products into platforms and locking in developers through CUDA — the “iOS of accelerated computing.”

Nvidia Built the Entire AI Infrastructure Stack

Nvidia didn’t just sell chips. It built the whole system:

Chips

GeForce, A100, H100, B100 — the engines of AI training and inference.

Systems

DGX supercomputers, HGX server architecture.

Networking

Through its Mellanox acquisition → dominance in InfiniBand, the “highway” for AI clusters.

Software

CUDA, cuDNN, TensorRT, Omniverse, NIMs — the software glue that makes everything work.

This “full-stack” approach created a powerful flywheel:

More developers → better software → more adoption → more data center wins.

Nvidia Rode Every Major Technology Wave

Unlike companies tied to a single cycle, Nvidia sat at the center of every major trend:

- PC gaming

- Cloud computing

- Cryptocurrency mining

- AI training

- Large language models

- Robotics

- Autonomous driving

- Simulation + digital twins

Each wave added new buyers, new markets, and new demand.

By 2025, Nvidia chips became the most scarce technology resource in the world.

CANSLIM Catalysts

Earnings: Multiple triple-digit EPS growth periods (2020 – 2025)

New: CUDA, DGX systems, A100, H100, Blackwell — each cycle fueled a new leg higher

Supply & Float: Relatively tight float; heavy institutional demand

Leader vs. Laggard: Nvidia dominated GPUs, AI acceleration, and high-performance compute

Institutional Sponsorship: Became the AI darling for institutions

Market Direction: Led the AI bull market from 2020 – 2025, becoming the benchmark for the entire theme

Nvidia Became the Most Important Company of the AI Era

Nvidia’s rise wasn’t luck.

It was decades of:

- Vision

- Architectural dominance

- Relentless execution

- A software ecosystem with gravitational pull

- And demand measured not in millions — but tens of billions per quarter

Jensen Huang didn’t build a chip company. He built the compute layer for the next industrial revolution.

Disclosure: This is not financial advice.