How Tesla Returned 199x

Folks,

I’ve talked about Tesla all year. In January, I said that Elon’s EV Maker was at the cornerstone of my Godspeed thesis. The reason being — Elon has his hands in everything — autonomous mobility, semiconductor manufacturing, energy storage, AI, rockets… the list goes on.

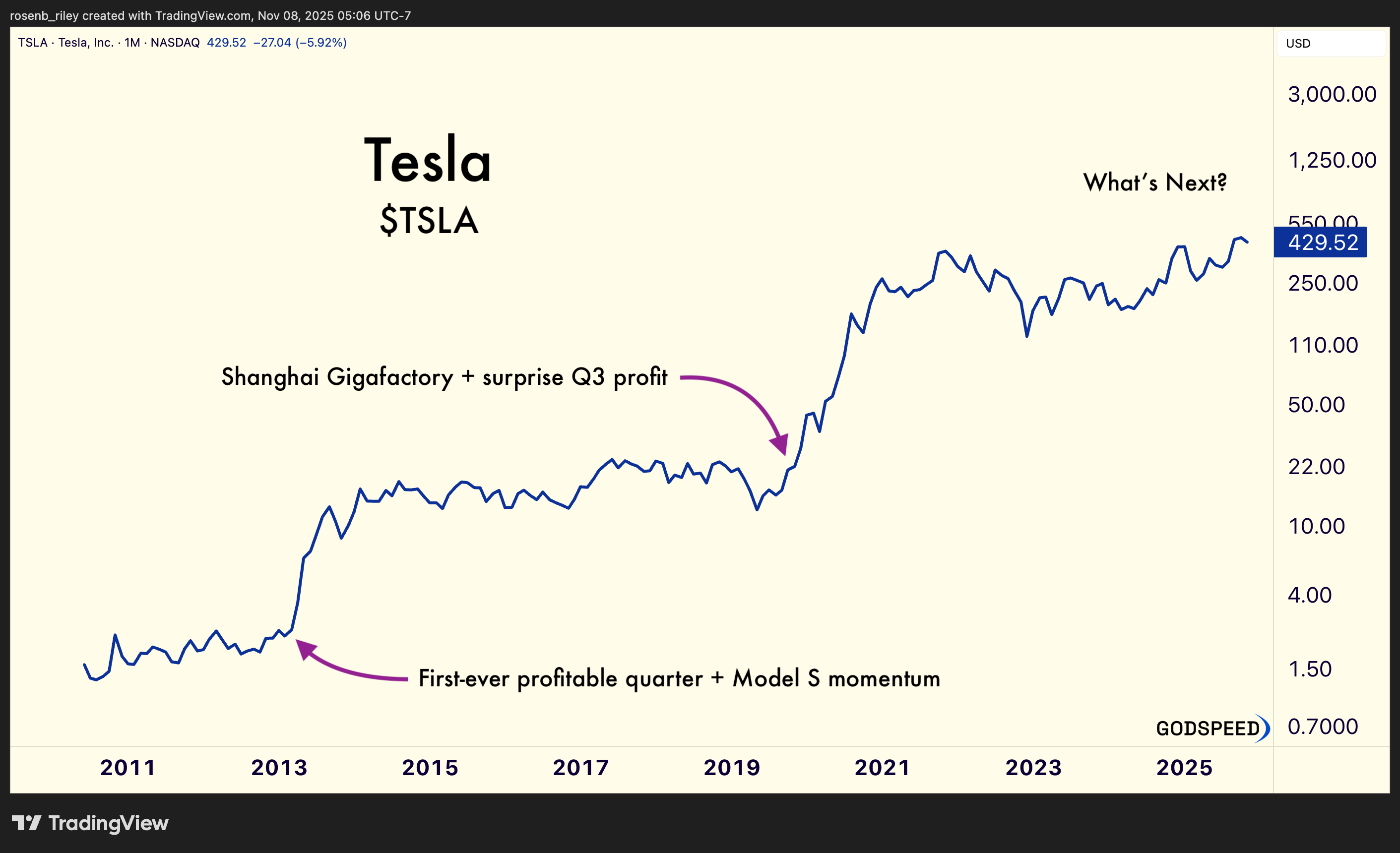

Today, I’ve compiled a simple case study for us to better understand how Tesla returned 199x since its 2010 IPO.

This guide doesn’t provide a direct indication as to where Tesla will travel next, it provides a better understanding as to how companies produce outstanding returns.

Let’s dive in.

Part 1: Tesla’s Timeline of Inflection Points (2010–2023)

Here’s a clear, product-led timeline of Tesla’s historical events, layered with capital raises, credibility events, and institutional belief.

- 2010 – IPO at $17/share; raises $226M. Buys Fremont factory from Toyota.

- 2012 – Launches Model S; disrupts luxury EV market.

- 2013 – First quarterly profit; stock doubles. O’Neil-style breakout.

- 2014 – Announces Gigafactory with Panasonic.

- 2015 – Launches Model X and Autopilot; narrative shifts from EV to tech.

- 2016 – Unveils Model 3 ($35K EV); >325K reservations in one week.

- 2017 – Model 3 production begins; enters "manufacturing hell."

- 2018 – Hits 5K/week Model 3 rate; two profitable quarters. SEC drama.

- 2019 – Opens Gigafactory Shanghai; reveals Cybertruck.

- 2020 – Delivers 500K vehicles; first full-year profit. Joins S&P 500.

- 2021 – Hits 936K deliveries; $1T valuation; Austin HQ move.

- 2022 – Opens Giga Berlin and Texas; 1.3M deliveries.

- 2023 – Cybertruck production begins; Model Y becomes best-selling car globally.

Part 2: The Drivers Behind Tesla’s 199x Ascent

Tesla's exponential growth wasn’t the result of one great product or moment. It was a combination of compounding edges that fed into each other:

1. Relentless Product Innovation

- Tesla iterated from luxury (Roadster, Model S) to scalable mass-market EVs (Model 3, Model Y).

- Each launch improved affordability, range, or performance.

- Autopilot and Full Self-Driving (FSD) positioned Tesla as a tech giant, not just a car company.

2. Manufacturing at Scale

- Unlike most startups, Tesla didn’t outsource production. It built and owned its Gigafactories.

- Massive cost leverage came from vertical integration: batteries, software, sales.

- Global plants (Nevada, Shanghai, Berlin, Texas) supported volume and margins.

3. Brand and Narrative Power

- Elon Musk’s polarizing visibility created constant narrative tailwinds.

- Tesla became a mission-driven cult brand: sustainable energy, not just transportation.

- Media, memes, and retail enthusiasm made Tesla an internet-native stock.

4. Financial Breakthroughs

- From 2013–18, Tesla had spotty profits; then came durable free cash flow in 2020.

- Regulatory credits boosted early profits; scale and gross margin discipline sustained them.

- Entry to S&P 500 in Dec 2020 marked institutional acceptance.

Part 3: What Would William O’Neil or Nicolas Darvas Say?

As a young investor // asset allocation, I’ve studied the greats like William O’Neil and Nicolas Darvas.

From a CANSLIM lens, Tesla showed:

- Current earnings: Breakout quarters in 2013, 2018, and 2020.

- Annual earnings: First full-year profit in 2020, accelerating afterward.

- New products: Model 3 launch, Autopilot, Cybertruck. (Robotaxi, the Semi and Optimus are TBD)

- Supply and demand: Huge reservation spikes (Model 3: 325K in a week).

- Leader: #1 EV brand globally.

- Institutional: S&P 500 inclusion, ARK & Baillie Gifford as major holders.

- Market: TSLA soared with NASDAQ and ESG tailwinds.

Darvas-style traders would have noticed:

- Price consolidations followed by explosive breakouts.

- Momentum fueled by both narrative (Elon) and numbers (deliveries).

- Strong volume surges on news: profitability, inclusion, new models.

Conclusion: The Blueprint for Future 100x Plays

Tesla built a company that made cars cool, clean energy profitable, and capital market participants believe.

This wasn’t luck. It was the product of compounding innovation, global ambition and a long-term vision.

Tesla’s story provides a template. It may not be the next company to 100x. But it's likely the next 100x will share some of the same DNA —

- Market creation

- Vertical integration

- And a story that makes us believe.

The Chart

Resources

Tesla Timeline: A Journey Through Innovation

How To Make Money In Stocks - William O’Neil

How I Made $2,000,000 In The Stock Market - Nicolas Darvas

Next in the series: America’s Apple.

Disclosure: This is not financial advice.